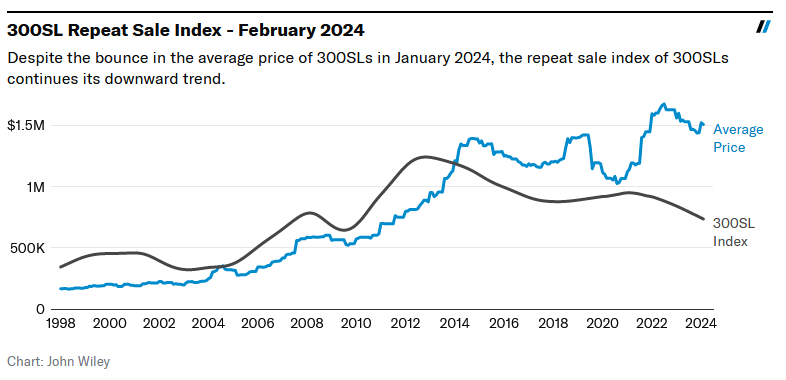

The Mercedes-Benz 300SL W198 debuted in New York some 70 years ago this week. It was at the forefront of the car world then, and now that it is a valuable and sought-after collector car, the 300SL tends to lead the market today. Hagerty don’t mean in value—there are plenty ahead of it in that regard. Rather, 300SL repeat sales offer the perfect set of data to track as an index, and Hagerty Insider has used this tool to provide insight about the status of the collector market as whole since 2017.

Hagerty last checked in on the 300SL Index in February 2022. At that time, the average price of 300SLs was well above the index, suggesting that the market was overheated. The Hagerty Market Rating peaked a couple of months later in 2022 and has fallen nearly every month since, indicating that the divergence in the metrics of the 300SL index sent the correct signal. This data yielded a similar insight once before—the first time the split between the index and the average price occurred was from 2013-2015, presaging another market correction. With the most recent boom having retreated to pre-pandemic levels, Hagerty decided to take another look at the 300SL index and see where things stand.

With the January Auctions in the books, the average price of 300SLs is up again a little. Barrett-Jackson sold a 300SL Gullwing for a record price (for a non-alloy bodied car) at $3,410,000. The car boasts a world-class restoration but incomplete early history. However, the index ignores those exceptional sales by design and instead shows how the market values unexceptional 300SLs over time. (To be specific, these are quality cars, if not the ones stealing the show at auction). If the index reflects the outlook of investors who merely want a 300SL in their portfolio, their outlook appears to be turning bearish based on the continuing diverging downward trend of the index.

Conversely, the average sale price bump in 2022 reflects how 300SLs rarely seen on the market (hence cars that are not in the repeat sale index) are getting greater prices. If the average price reflects the perspective of enthusiasts who want a specific top-flight car and its history, their outlook is more bullish.

To illustrate how the market often treats more frequently traded 300SLs, this 1960 300SL roadster sold in August 2023 at RM Sotheby’s Monterey auction for $1,270,000 after selling at RM Sotheby’s Santa Monica auction in 2017 for $1.1 million—an annualized return of 2.3 percent. Both times, the car sold approximately 15 percent below its condition-appropriate value. In contrast, a 1962 300SL roadster that hadn’t been to auction since 2000 was sold by Gooding & Company at its Amelia auction in 2023 for $1,792,500, five percent above its condition-appropriate value. Additionally, the 300SL market might have recently become more sensitive to provenance than usual, as a case of chassis number fraud was revealed last year.

Across the market, Hagerty has begun to note the increasing delta between top cars and merely good-condition examples, as well as softer prices for cars lower on the condition scale. The split between average sale price and the 300SL index bears this out—Barrett-Jackson prime-time prices aside. Hagerty will be watching closely in the coming year to see how these data continue to unfold.

Report by John Wiley

find more news here…