In the week or so that follows any major auction, Hagerty’s team of analysts break down specific sales and looks for broader trends or observations that might be coalescing. From the recent Florida auctions, a few factors suggest that despite all the market movement in the last 18 months, the core focus of the collector car hobby remains healthy. What’s more, trends that may have shown growing momentum in the go-go market of 2021-22—like the rise of modern supercars—have indicated some signs of softness. Hagerty dig into some of these outcomes from Florida below.

Cars from core eras are still in demand

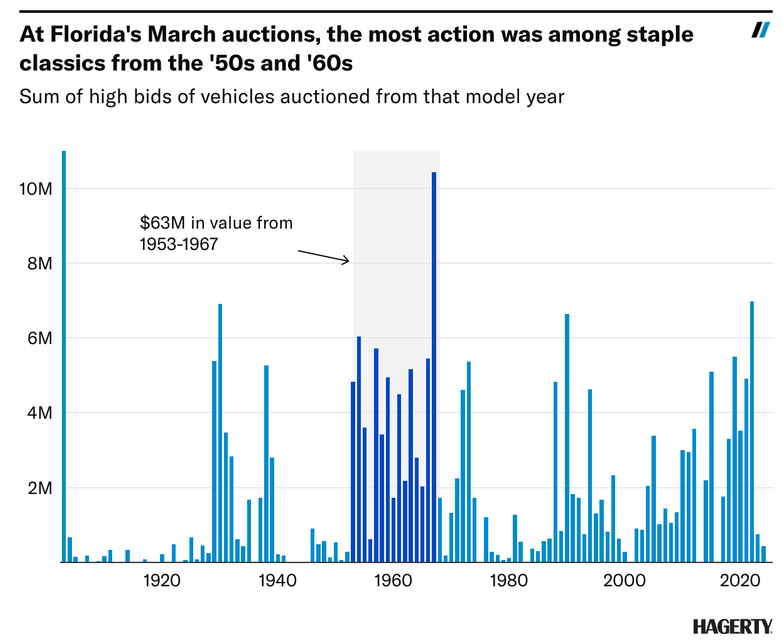

As the demographics of the collector car market evolve, the concern that older classics may fall by the wayside continues to be a topic of conversation. While there is some evidence that may be happening among certain models, reports of the death of old cars have been greatly exaggerated. Broadly speaking, the market for cars over fifty years old is very diverse and healthy. Few alive today had a 1903 Mercedes-Simplex image on their wall as a kid, but it was the most expensive car at the March Florida auctions. It’s not just one car, either—models from the ’50s and ’60s made up a huge chunk of the value that exchanged hands last weekend.

Quick flips are increasingly risky

Not too long ago, many people came to think of classic cars as money printers. It wasn’t all that unreasonable a concept—for cars bought in 2021-22 and then sold in the first three months of 2022, the average return was seven percent (that’s just the average—a raft of cars saw much more dramatic growth during this period). Those days are over. The median return on a car bought at auction during 2023-24 and then sold in 2024 so far is zero percent.

Buyer discipline continues to carry the day. Hagerty observed that across all segments in March’s Florida auctions—special examples would transact (and sometimes at very strong prices), but bidders were more guarded with their paddles overall. This means that quick monetary gains in the collector car market are much harder to come by now, and dealers aren’t guaranteed to make a quick buck.

The analysts have also observed a change in buying and selling behavior among repeat sales: During the pandemic, there was a prevailing theme of dealers and flippers picking up a car at live auction and then making their profit by selling it online. Hagerty is beginning to see the opposite, and not just because the attendance is back at live auctions. With an ever-increasing number of cars available online, pressure to sell at no reserve, and buyers holding back, it’s now a bit easier to score a deal online.

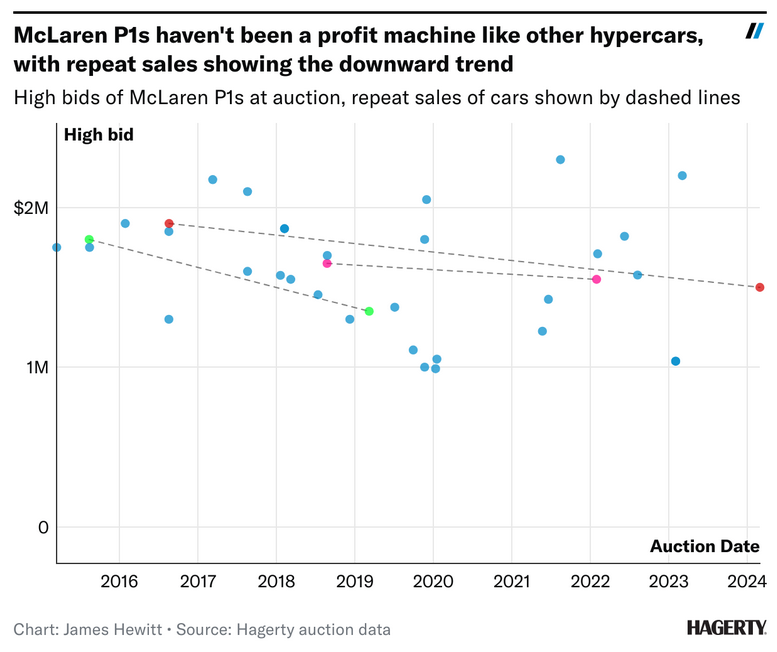

Super- and hypercar struggles

Not every limited-edition hypercar is a sure-fire bet. Hagerty has observed some depreciation in this segment as manufacturers keep churning out the next one and the next one. Buyers could be getting hesitant that these cars are guaranteed investments. On top of that, so many are low-mileage, nearly in-the-wrapper examples that in this market it appears buyers have to really want that particular car in order for it to move. Of the 13 2010+ supercars bid above $1M, only four made it beyond their low estimate. The McLaren P1, one of the cars at the center of a flurry of hypercar activity early in the last decade, went 0 for 2 across the block. Only one of four Lexus LFAs—a darling car with a meteoric rise in the last few years—sold at this past week’s auctions.

Despite some big hits and misses, the Porsche market was rational

As stated in the auction report, there were some high-profile Porsche no-sales, along with a couple of transactions that had to be completed after the auction. This appears, at least in part, to be a continuation of rationality in the Porsche market that Hagerty reported on in December. Porsche buyers have gotten very particular, but when they identify something they want, they’re willing to pay up for it. That enthusiasm is reflected in the data: The median condition-appropriate premium vs. the Hagerty Price Guide for Porsches was 13 percent, which is greater than the 10 percent median for the sales overall.

Report by Hagerty Insider

find more news here…