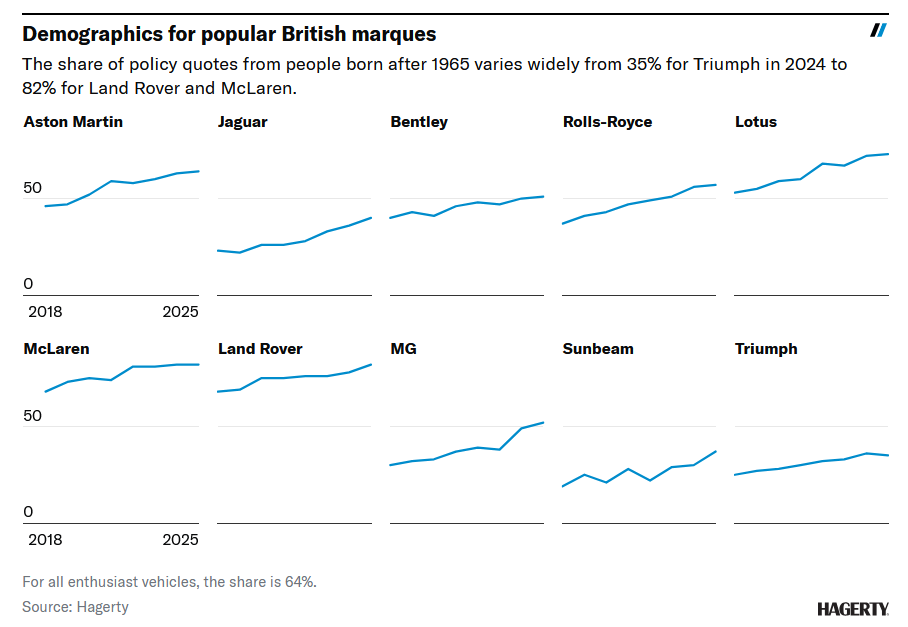

Although we talk about “the collector car market” a lot around here, it’s more of an amalgamation of smaller market segments than one big monolith. And even within one market segment, there’s plenty of variation. Take British cars, for instance. In the latest update of our price guide, Hagerty’s British Car Index was the worst performing of the 11 indices we track, both over the past quarter (down -4%) and over the past 12 months (down -7%). At the same time, Jaguar E-Type Coupes, 2002-06 Minis, and 1980-88 TVR 280is were among the Price Guide’s biggest gainers in the first part of 2025.

Another way we measure the car market is through buyer demographics, which we measure through insurance quote activity. Cars that are disproportionately popular among younger buyers are more likely to gain collectability and value in the future, while values for ones that aren’t may face more difficult roads ahead. Here, too, there’s some big variation among British classics.

The chart above measures buyer interest in North America, among enthusiasts born after 1965 (the start of Gen X) for 10 of the most popular British marques, from 2018-25. This cohort (Gen X, millennial, Gen Z) makes up 64% of buyer interest across all vehicles. Correspondingly, makes above that 64% threshold on this chart skew younger, while makes below 64% skew older.

Some of these figures aren’t much of a surprise. There haven’t been any new Triumphs or MGs in the U.S. for four-and-a-half decades, and there haven’t been any new Sunbeams for nearly six. Older Gen Xers may have some personal connections to things like TR6s, TR7s, and MGBs from when they were new, but for millennials and Gen Zers they have always been classic cars from their parents’ generation.

On the opposite end of the spectrum, McLaren has only been a volume manufacturer for about 15 years, and its products are among the more attainable European exotics, so it makes sense that its core demographic would be on the younger side. Lotus is a mixed bag, as there are some classic models that skew older (84% of buyer interest for 1963-74 Elans comes from baby boomers or older), but others like V-8 Esprits, Elises, and Emiras are mid-engined semi-exotics that are newer, generally priced lower than equivalent German and Italian cars, and quite popular among younger buyers who like Radwood-era and newer cars.

There are some surprising differences between similar makes, especially in the JLR (Jaguar Land Rover) camp. Jaguar is, technically, still a carmaker, as well as one that has had a consistent North American presence for decades. Values for its cars in our price guide span nearly nine decades, and from a few thousand dollars to a few million. Yet buyer interest for Jaguars skews older than it does for long-defunct MG, likely because many of the most sought-after Jags for enthusiasts are from way back in the company’s past. Land Rover, meanwhile, skews surprisingly young.

Former corporate cousins Rolls-Royce and Bentley show a slight but surprising difference. Despite its chauffeur-driven, Grey Poupon-spreading traditions, Rolls-Royce actually skews slightly younger than Bentley, which has always been the more sporting of the pair, and is mentioned in at least as many rap lyrics. Finally, Aston Martin’s demographics are right in line with the market as a whole.

Tastes change, and demographics like this aren’t a perfectly predictive force. When it comes to some of our U.K. favorites, though, the above data is a useful clue as to which vehicles will be relevant well into the future, and which ones might see a shrinking fan base.

Report by Andrew Newton

find more news here.