What do Rolls-Royce and McLaren have in common? Not much. One is a nearly 120-year-old builder of silent, supple luxury cars. The other is about half that age, and makes loud, fast cars. One has nothing whatsoever to do with racing. The other has motorsports baked into its DNA, and built nothing but race cars for most of its existence.

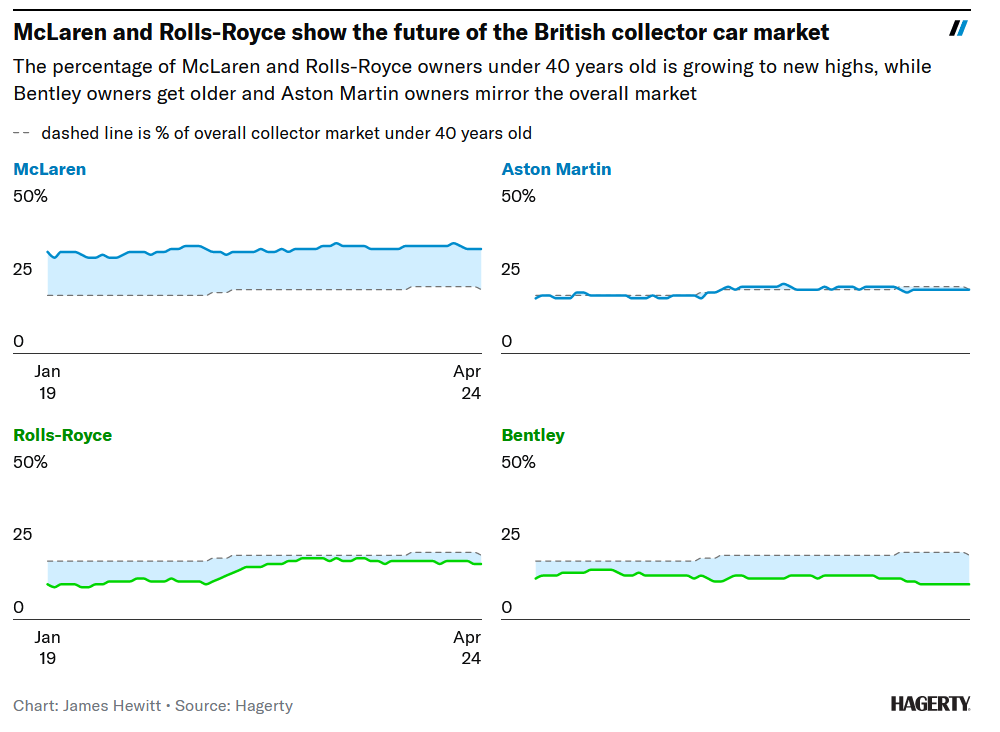

You get the idea, Grey Poupon and papaya (McLaren’s traditional color) don’t mix. But they are both famous English carmakers, and they’re both still very much in business, with established dealership networks. And they both, somewhat surprisingly, enjoy a fairly young ownership base, measured by Hagerty’s insurance quote data. The number of people under 40 years buying a Rolls-Royce or a McLaren show demographics shifting at a faster pace for these two companies than for other British brands.

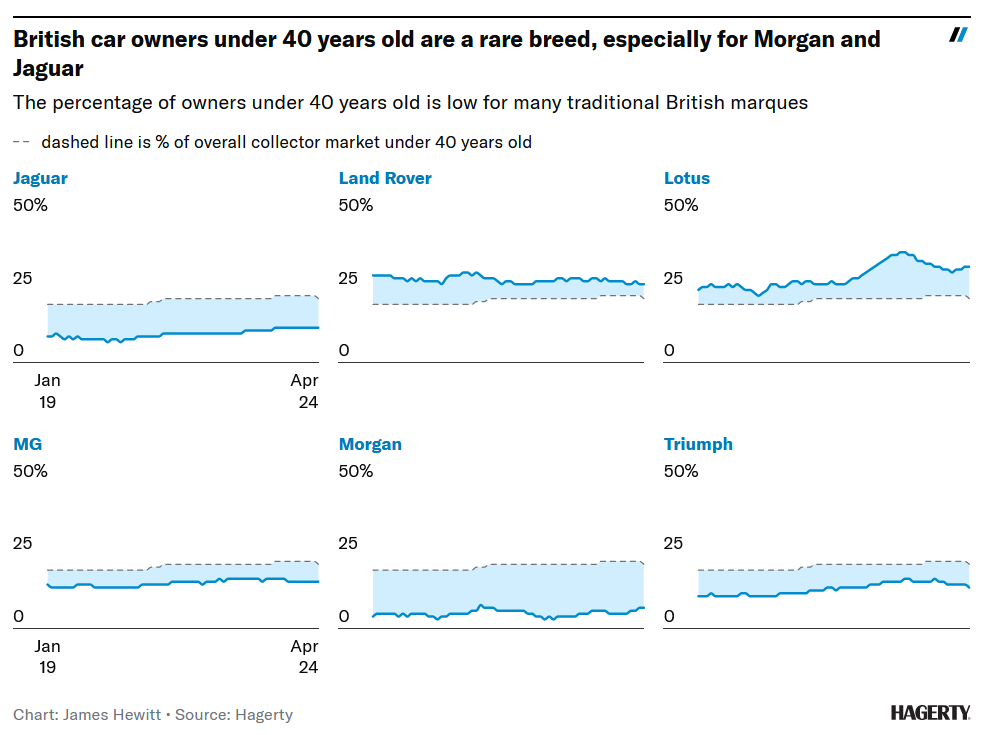

In general, the market for British collector cars has been stable, even through fluctuations in other parts of the classic car market. Hagerty’s British Car Index, for instance, is just up one percent from where it was in 2021. Enthusiasm for Britain’s best also tends to skew towards older buyers. For example, 65.5 percent of buyer interest for Triumph TR3s comes from Baby Boomers or older and for 1961-67 Jaguar E-Types the number is 66 percent. Yet this segment of the car enthusiast population makes up barely one third of the market as a whole. For Morgans, it’s even more skewed. Just seven percent of buyer interest comes from enthusiasts aged 40 or younger.

There are some youthful exceptions. About 32 percent of buyer interest for Lotus comes from enthusiasts 40 or younger, and for Land Rover it’s 27 percent, compared to just 18 percent for Porsche and 17 percent for Ferrari. The share for both Lotus and Land Rover, though, has been steady. For Rolls-Royce and McLaren, it has grown conspicuously. For McLaren, it makes sense. Over the past decade or so it has been churning out more and more new supercars that are loud, brash, and competitively priced—exactly the kind of thing that appeals to less mature buyers.

Less so for Rolls-Royce, who may build “The Best Car in the World” (their words) but does so for a more discerning type of motorist. We tend to think of the U.K.’s other luxury high-end luxury carmaker—Bentley—as having a more youthful reputation. But that’s wrong, apparently. Just 12 percent of buyer interest for Bentleys comes from enthusiasts 40 or younger, and that ratio is decreasing.

Meanwhile, according to our data, younger buyers turning to Rolls-Royces are gravitating towards Silver Clouds from the 1950s-60s and Silver Shadows from the 1960s-70s. On one hand, this is a bit surprising given the age of these models. On the other, it makes sense because these two models are among the cheapest ways to get a Spirit of Ecstasy on your hood.

Interestingly, this youthful shift for Rolls-Royce in the classic car market mirrors a similar one for the company in the new car market. After a year of record sales in 2023, Rolls-Royce’s CEO Torsten Müller-Ötvös credited youthful clientele, noting that “we are now an average age of 42; we are even younger than a brand like Mini, for instance.”

So, while they may be completely different from each other, these two British badges look like they’ll be relevant in the collector car market for years to come.

Report by Andrew Newton