The collector car market, the stock market, and the economy rarely move in lockstep. Recently, the Dow has been in record territory, while the overall economy and the collector car market do their respective versions of a soft landing. Higher interest rates cooled the U.S. economy enough to tamp down inflation without pushing it into a recession.

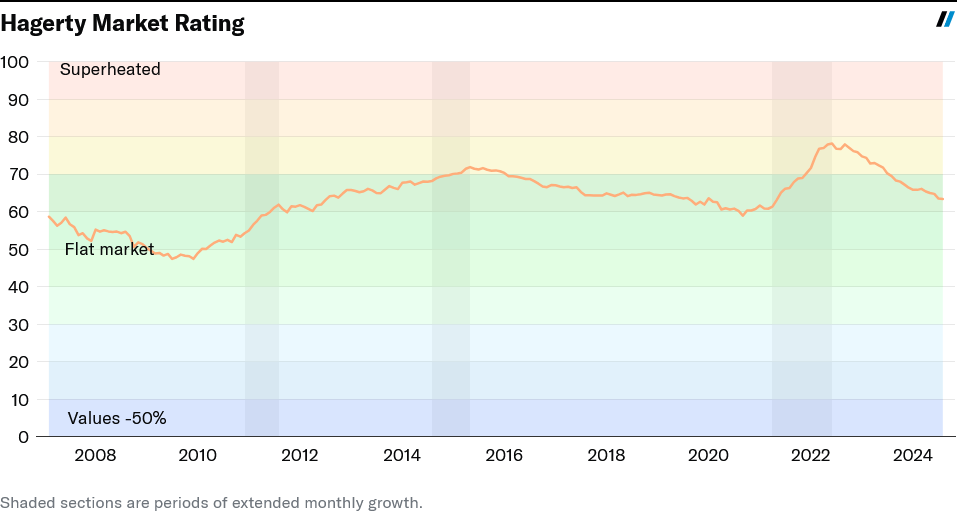

Meanwhile, air continues to come out of the once-frothy, pandemic-era, collector car market, and the mixed results at the Monterey auctions contrast with the monster numbers achieved there in the previous three years. Nothing drastic, mind you, but the Hagerty Market Rating looks like it’s still searching for its floor and is at its lowest level since the spring of 2021, though the rate of descent seems to be slowing, at least. This is all part of a healthy, maturing market.

Similar market conditions to those observed today have been seen before, even in the recent past.

The history of the collector car market, as it is known today, dates back to the late 1960s or early 1970s. Since then, there have been only two major downturns, both triggered by external “black swan” events. The 1980s run-up in collector car prices was boosted by the super-heated Japanese economy. Fueled by an uncontrolled money supply expansion and easy credit, real estate and stock market investments generated huge returns that helped assemble some massive car collections. In 1991, the Japanese asset bubble burst in spectacular fashion, contributing to a crash in the global collector car market that resulted in a “lost decade” for both the Japanese economy and the market for collector automobiles.

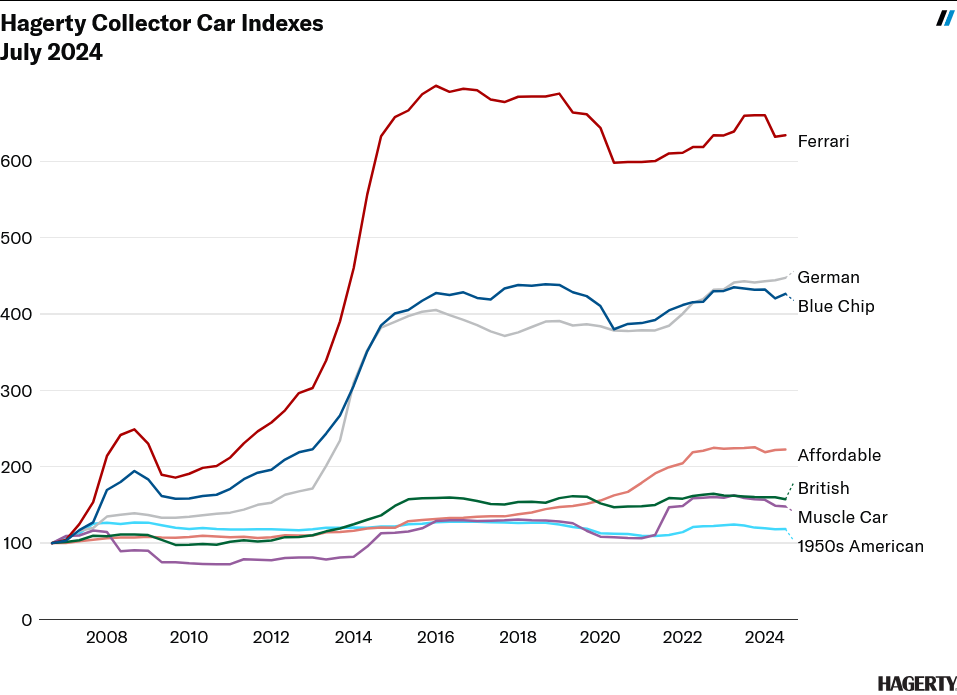

About 15 years later, a massive run-up in U.S. housing prices in the early 2000s created new wealth that was leveraged with easy home equity credit. Some of this newfound liquidity found its way into the collector car market with predictable results. The music stopped in late 2008 when the subprime mortgage market melted down. Muscle cars were hit the hardest, with average prices retreating about 40 percent.

What’s going on now doesn’t resemble either of those events. But it is reminiscent of 2014-15, the last time the market took a bit of a breather after experiencing significant appreciation.

In these types of situations, the top of the market moves first, as the wealthiest collectors tend to lead the charge in either going all in, or in pulling back. Currently, it’s the million-and-up market that is starting to show hesitancy to pull the trigger. About 13 years ago, when the economy was emerging from the worst recession of the post-war era, it was that market segment that led the collector car market comeback. By September of 2011, both the Hagerty Blue Chip Index and the Ferrari Index were exhibiting a distinct “U” shaped recovery, both having regained their pre-recession values, while the indices that consisted of less-expensive cars remained more or less flat in their recession-era troughs. It took another year for the middle of the market to come back, and another still for the entry-level cars to return to pre-recession levels. The market continued to expand significantly until roughly the end of 2014 when growth slowed down.

It’s debatable exactly what caused these last two market expansions to end. Perhaps not coincidentally, both the 2015 downturn and the current one followed the end of unprecedented levels of fiscal stimulus instituted in response to a significant economic shocks. In the 2010s it was the Great Recession. In the 2020s it was COVID. Whatever the precise reasons for the car market downturns of 10 years ago and today were, maybe it’s enough to simply note that nothing goes up forever.

It’s debatable exactly what caused these last two market expansions to end. Perhaps not coincidentally, both the 2015 downturn and the current one followed the end of unprecedented levels of fiscal stimulus instituted in response to a significant economic shocks. In the 2010s it was the Great Recession. In the 2020s it was COVID. Whatever the precise reasons for the car market downturns of 10 years ago and today were, maybe it’s enough to simply note that nothing goes up forever.

As the saying goes, past performance isn’t always indicative of future results. But I suspect that the hyper-selectivity and willingness to stand on the sidelines that characterize the current state of the million-and-up market will eventually reach the middle and entry-level markets. It might take a bit longer, but it seems inevitable that those markets will soon favor buyers, many of whom have been frustrated by ballooning prices for the cars they love and want, more than they have in the past several years.

Every market cycle eventually comes to an end, and the current trends likely signal the conclusion of the pandemic-era market exuberance. It’s nothing to be overly concerned about, particularly for the majority of owners who buy and enjoy what they like, and don’t worry much about the normal ebbs and flows of the market. It does, however, mark an important shift in buyer/seller behavior that’s worth keeping an eye on.

Report by Rob Sass