The first adult job for Dave Kinney was still in high school when he was working for a classic car dealer. They sold what they called “exotic” cars, a term that at the time encompassed Ferrari, Maserati, Lamborghini, Rolls-Royce and Bentley, some of the Mercedes Benz sports cars of the postwar era, and two- to 10-year-old cars from Iso, Ghia, Intermeccania, Excalibur and a few dozen other smaller marques.

New exotic car dealers were selling Maserati Boras as well as Ferrari Daytonas and Dinos. The Rolls-Royce Silver Shadow was still in new car showrooms, and the Lamborghini Espada was about to enter its second series. When he was 16 years old, he was the kid to the adults in the business, but he feels very fortunate to have had a behind-the-scenes view to a time when a new business model was forming—the modern classic car dealership.

Such dealerships became a huge, important part of the hobby and of the market. They still are, so he wanted to pose a few questions to three people who have been involved in the business for over 50 years for their take on where the market stands today for the cars they cut their teeth on. Namely, Ferraris from roughly 1960 all the way through the Dino and Daytona era of the early 1970s. This era includes what are currently some of the world’s most valuable collector cars.

First up is Dave Olimpi. Dave is an automotive consultant and broker who lives in Northern Virginia. He worked in the sales department of the now legendary Algar Motors dealership in Bryn Mawr, PA, in the late 1960s and early 1970s, and was the manager of Ferrari of Washington from 1994 until 1996.

Next is Edmund “Ed” Waterman of Fort Lauderdale, FL. Ed is the founder of both Thorobred Motorcars of Arlington, VA, and also the Founder of Motorcar Gallery in Fort Lauderdale, FL. Ed is who Dave Kinney worked for five decades ago, and it’s because of him he loves of cars became his career.

The final chat was with Marc Tauber, also a dealer and broker. Marc kept an office at and operated from The Stable in Gladstone, NJ for many years, and in the late 1970s was sales manager at Grossman Motors in West Nyack, NY. Marc is now brokering cars from his base of Scottsdale, AZ.

Where do you see the current market in 1960s-70s era Ferraris, basically the 250 SWB era through the Daytona and Dino era?

“Many of these car have been relatively easy to sell in the last 15 years; the last big problems were in 2008,” says Olimpi, referring to the overall car market decline in 2008, brought on by funny business in the housing market. Additionally, “there are not too many in the market who remember what happened in the late 1980s.”

Some good news, adds Olimpi, is that “a new, younger market for these cars is establishing itself,” and that in general these new buyers know how to research the problems and important details to look out for in these older models. “You will love the car if you buy and commit yourself to it. [When buying any car, you should.] Know what you’re in for, (both) the good times and the hard truths.”

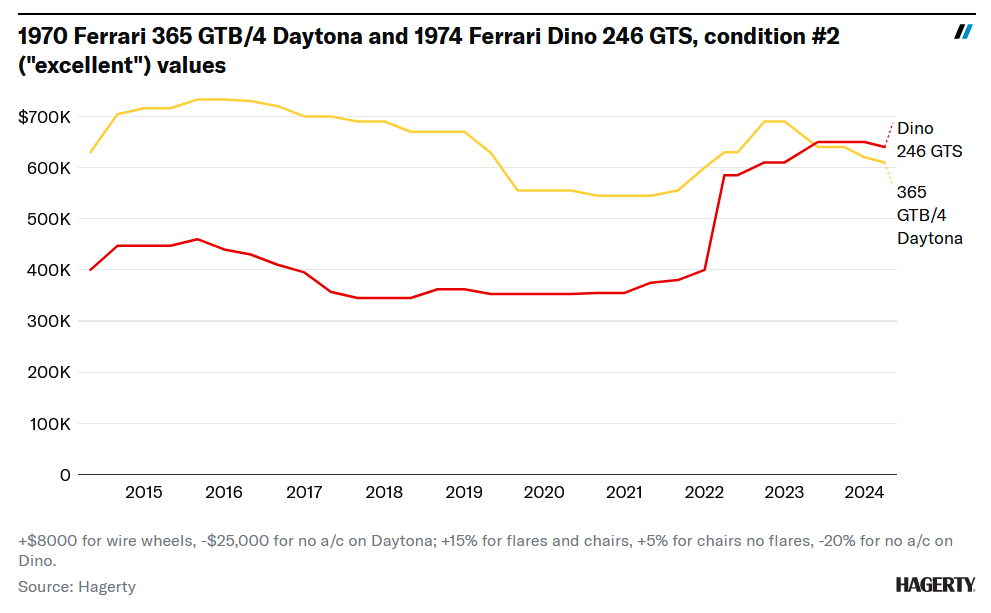

Waterman noted that “the 2024 market is fairly stable after some slight price reductions over about 12 months—a time when seller supply outpaced buyer demand. These adjustments have been made and have been largely accepted.” Waterman also said the cars that sell fastest in this market “are the cars that are in extraordinary condition or have extraordinary attributes, such as originality, or an outstanding history,” and that “this was a blip that will have longer term effects. The interest is expanding more into exotics and supercars from a later vintage.”

Marc Tauber added his thought about the market for the particular “Enzo era” cars we are discussing. “The COVID bubble is over, and we have returned to pre-COVID prices”.

“[This is yet another] changing of the guard. We all know now that, despite the hype that said otherwise, younger people like cars – just not the cars of our generation”

“As the younger buyers get more sophisticated in their tastes, the demand will be there for these cars that were largely made in very limited numbers, often just 300 or a bit more or less per model.” Marc used the Duesenberg market as an example of a car perceived as exceptional by a previous generation that has since found its place in the market with the next generation. “The marque had gone down in value for a time in the last 15 years or so but as the next generation of buyers came into play they began to appreciate [Duesenberg’s] place in automotive history and their virtues in build quality, beauty and performance. They then regained their significance and desirability amongst newer collectors.”

Do you have any short-term or long-term advice when looking for a Ferrari of this era?

For Marc Tauber, “buy what you love is both my short- and long-term answer, and buy the best example that your finances allow.”

Waterman says similar: “Buy quality and do your research. Buy what you like, not what others might say.”

And for Olimpi: “Don’t buy as an investment. The days of a sale that was reported in magazines as ‘buy the car—get the restoration for free’ is over, as are the days of someone buying cheap and holding on. Dealers need to buy today and sell tomorrow, but that’s not something an owner should set their focus on. Do more hands-on research. Buying cars without you, or someone you appoint, looking at them is risky. Average cars are sometimes the same price as great ones.”

You’ve been in the business for over 50 years, yet something never imagined has happened: Dinos selling for more than Daytonas. Why are Dino prices rising, yet Daytonas seem mostly stagnant?

Ed Waterman: “A Dino can be used by a broader segment of the market, whereas owning a Daytona takes more of a commitment. There is an almost universal appeal for Dinos, they resonate more with a younger generation. But never count out the Daytonas. They are very important cars for a large variety of reasons and will remain so well into the future.”

Dave Olimpi: “It’s anyone’s guess but for a Sunday drive in the country, [I’ll take a] Dino. The Daytona is the car you want for a drive from Paris to Monte Carlo. Most people don’t know which car is best for them until they live with it.”

Marc Tauber: “Almost everyone loves the look of the Dino. It’s a mid-engined, lighter-steering car that is a delight to drive,” and it makes great noises! “But it is not a supercar. Daytonas are an amazing cars to drive, but with heavy suspension and steering.”

A car’s history has become more important to buyers in the marketplace. Many of these cars are from an era when there was no federal law prohibiting someone from rolling back an odometer, there was no CARFAX, and few owners saved all their receipts. What kind of history should a prospective buyer look for?

Dave Olimpi: “[I’ve talked to some] authorities who say that complete documentation adds 20 percent to the value of a car. It’s certainly clear that the more legitimate documentation, the better. A complete history also helps you feel better about the car that you bought.”

Ed Waterman: “I feel that history is often oversold, as we’ve all seen that certain elements can be somewhat made up or at least enhanced over time. A purchaser cannot overemphasize the quality of the car. Remember, back in the day, the secondary market on used Ferraris was for people who used them and used them hard. That second owner was not a guy who put it on a trailer! Get a mechanical inspection from a real expert before purchasing.”

Marc Tauber: “Original cars should be worth much more than restored cars. Once the North American buyer gets more in tune [with the thinking in Europe] this will right itself. Some buyers are still looking for the over-shined, over-plated, and overdone. Today’s buyer is often someone who doesn’t want a car restored to perfect. With a race car, sometimes a picture of car on fire is a real badge of courage!”

Report by Dave Kinney

find more news here…