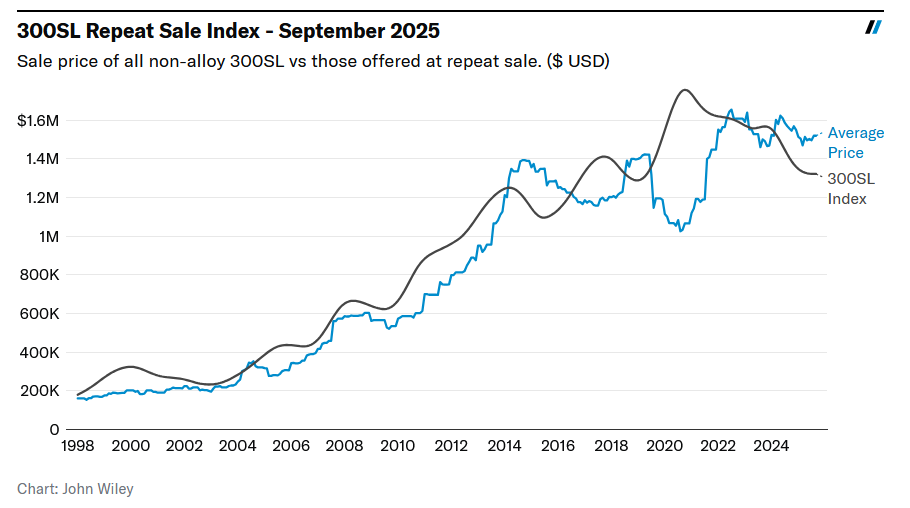

The Mercedes-Benz 300SL has been around for over 70 years. It was at the forefront of the car world in its heyday, and has been a highly sought after collector car for decades. As a collector car, the 300SL also tends to lead the market. This does not refer to value, as there are many examples that surpass it in that respect. Rather, repeat sales (multiple auction transactions for the same car over time) for 300SLs offer the perfect set of data to track as an index, and Hagerty Insider has used this tool to provide insight about the status of the collector market as whole since 2017.

With the recent Monterey Car Week auctions and the growth of online auctions in the $1M+ segment of the market, now is a good time to check in on the 300SL Index. There are two reasons why: The auctions provided some repeat sales (that go into the 300SL Index) and new-to-auction cars, and the overall results raise questions about the direction for the near-term future.

As background, when we checked in on the 300 Index in early 2022, the average price of 300SLs was well above the index, suggesting that the market was overheated. The Hagerty Market Rating peaked a couple of months later and continued to consistently fall, indicating that the divergence in the metrics of the 300SL index sent the correct signal. Then, the last check-in with the 300SL Index in February 2024 showed a growing divergence between the average sale price (the jagged blue line) and the smooth 300SL Index. The explanation for the divergence was a recognition that the market increasingly prioritizes extraordinary cars (new to market) and pays less for ones that are familiar to the market (e.g., the repeat sales).

The latest update looks a bit different from the last version because it is a restatement of it. The motivation for restating it, rather than appending an update of recent transactions to the past 12 months, is that it better incorporates the full history of repeat sales into the shape rather than just the most recent observations. Some features remain, such as the dot-com bump in 2000, another in early 2008, and one in 2014. New features are a bigger bump in 2018 and a much more pronounced pandemic-era run-up in 2021.

Digging into the 2018 bump shows a few (three) repeat sales of cars that had been held for several years, and one that had been held for 26 years! The length between auction sales of that car blurs the line between the fresh-to-market sales, often seen in the average price, and the routinely seen at auction sales of the repeat sale index. The 2021 peak is well known.

The subsequent drop in the index is reflected in the Hagerty Market Rating, which has been drifting down consistently since then. Some cars like a 45-years-owned example, which sold for $1.3M before fees, helped support the moving average. Conversely, a 1963 300SL Roadster sold for $2.15M last month, but had previously sold for $3.1M in 2021, which is an annualized loss of 8.6 percent. A couple of repeat sales like that have pulled down the 300SL Index further this year.

In the market for collector cars like the 300SL and others, the premium is still going to fresh-to-market examples, while frequent drives across the auction block tend to reduce the return. A momentum shift towards more modern supercars has also been observed. While it is unlikely that this trend will extend to this segment of the market, the development will be closely monitored.

Report by John Wiley

find more news here.