We’ve heard all about it on the news. Markets and governments around the world are reacting to it. Armchair economists and car people across the Internet are pontificating about it. Yet nobody seems to completely understand it, what its impact will be, or even how long it will last. “It,” of course, refers to “Proclamation 10908—Adjusting Imports of Automobiles and Automobile Parts into the United States,” part of the sweeping package of economic policies that many are now simply referring to as “the tariffs.”

We are neither an economics blog nor a political one, so this isn’t the place to debate the hows and the whys of tariffs, delve into the intricacies of globalization and supply chains, or examine the impact of free trade agreements on North American automobile production. That said, the tariffs will impact the world of enthusiast cars, whether directly or indirectly. After reaching out to import businesses, shops, auction houses, and Customs and Border Protection, what’s clear is that the situation is extremely fluid. So, as of this writing, (updated April 9, 2025) here’s what we know and what we don’t know about how the tariffs will impact enthusiasts, enthusiast cars, and the industries that support them.

Tariffs on New Cars

The biggest and most immediate component of the new tariffs affects new cars for sale. Proclamation 10908 outlines a 25 percent tariff on foreign vehicles and automobile parts entering the U.S. For imported automobiles, this comes on top of the already existing 2.5 percent tariff for a total of 27.5 percent. For light trucks, the new tariff stacks upon the existing 25 percent tariff established in the 1964 “chicken tax,” for a total of 50 percent.

Of course, on April 9, a 90-day pause in “reciprocal” tariffs on all countries except for China were announced, with a move to baseline tariff of 10 percent for the next three months.

The market for new passenger vehicles and light trucks in the U.S. was roughly $770 billion in 2024, yet no vehicle is currently produced 100 percent in the U.S. with 100 percent U.S.-made parts. Many (but not all) foreign carmakers also have factories in the United States. In fact, the biggest exporter of American-built vehicles by dollar value is BMW, thanks to the Spartanburg, South Carolina, plant responsible for the X3, X5, X6, X7, and XM.

Domestic manufacturers, meanwhile, have optimized their production to take advantage of free trade, particularly with Canada and Mexico as outlined in the United States-Mexico-Canada Agreement (USMCA). The Wall Street Journal found that a single piston crosses a border six times before it helps power a new Ford F-150.

Vehicles complying with the USMCA are, until May 3, temporarily exempt from these new tariffs, and importers may only have to pay a 25 percent tariff on the “non-U.S. content of such automobile parts.” Since this announcement, Stellantis took steps to temporarily shut down a Windsor, Ontario, plant and temporarily lay off 900 U.S.-based workers. Audi, meanwhile, is reportedly holding cars at U.S. ports and is freezing shipments to the U.S. until further notice.

The tariffs will have a larger impact on smaller and/or more enthusiast-oriented foreign carmakers, given their lack of manufacturing presence in the U.S. Before the tariffs were even enacted, Ferrari announced an increase in the price of all U.S.-market cars imported after April 2 by up to 10 percent. Over in Britain, Jaguar Land Rover has announced “a shipment pause in April, as we develop our mid- to longer-term plans,” and Lotus confirmed it has “temporarily paused shipments to the U.S. as we assess the situation and determine the best path forward.”

Tariffs and Vintage Cars

After the tariffs were announced on March 26, there was no clear information on whether they would apply to vintage (25 years or older) vehicles or not. In the days since, reports have varied wildly, and at this point, it’s still unclear exactly what importers can expect.

On April 1, a U.S. Customs representative told Automotive News that the agency had no information regarding tariffs on imported vintage cars or parts, and a representative for California-based Toprank International Vehicle Importers told the publication that “as of today, we are set to see a tariff of 27.5 percent on all cars and a 50 percent tariff on all trucks regardless of age.” Japanese Nostalgic Car proclaimed: “Get your JDM dream car now, because a 25 percent tariff is coming.”

On a high-dollar car, an extra 25 percent amounts to a massive amount of money. On the Carmudgeon podcast, co-host and co-founder of OTS & Co., Derek Tam-Scott, recounted importing a car worth “in excess of $3M” that was scheduled to fly to the U.S. on April 2. If the car got slapped with an additional 25 percent tariff, it would mean more than $700K to get it into the country. He was able to get the car on an earlier flight even though “there’s a lot of people who were in the same boat and freaking out … that was a huge relief but it was also an extremely stressful experience with three-quarters of a million dollars at stake, and it’s still not entirely clear whether [the tariffs] include old cars.”

Then, on April 2, the official Federal Register notice (under heading 9903.94.04) made a distinction that the tariffs apply specifically to all vehicles newer than 25 years old. It’s unclear what prompted this last-minute reprieve (Fortune reported the government was still finalizing tariff plans 24 hours before their announcement), but many importers and enthusiasts are interpreting it as a much-hoped-for exemption. “[I]t feels like a true miracle! … What a fantastic outcome!” said Toprank.

It would be a relief for the auction business as well. According to Barney Ruprecht, Vice President of Auctions for Hagerty Marketplace and Broad Arrow (which has an auction in Italy next month), “there was quite a lot of uncertainty from clients and the industry as a whole if classic cars would be subject to the higher tariffs or not … With our average car being older than 25 years, hearing the rate remains the same at 2.5 percent is welcome news.”

Still, nothing is set in stone at this point. Brian Jannusch of Toprank, the import specialists who had just been celebrating the apparent 25-year exemption, this week went to U.S. Customs in Long Beach, California, to get some clarity:

“What they told me is according to U.S. Customs here in Long Beach, the enforceable tariff for a car, regardless of its age, even if it’s 25 years old or older, is 25 percent. And they also have said that some of the cars that did clear Customs at 2.5 percent, they’re actually going back and recollecting an additional 22.5 percent from anyone who had a car cleared here in Long Beach after April 3,” he said in a post on Instagram. Even after nearly a week, the situation seems to be ever-changing and enforcement inconsistent.

Tariffs on Parts

The situation regarding classic parts is even murkier than that of vehicles.

A similar 25 percent tariff for imported parts and major components has been announced but enforcement is delayed until May 3, 2025. There is no explicit exemption for classic car parts. What about parts that were rebuilt or recommissioned overseas? Again, it isn’t clear.

Many classic vehicle parts, even those for American vehicles, are produced overseas, often in China. Previously, packages valued under $800 could enter the U.S. duty-free thanks to something called the de minimis exemption. The White House has clarified that this exemption is now closed.

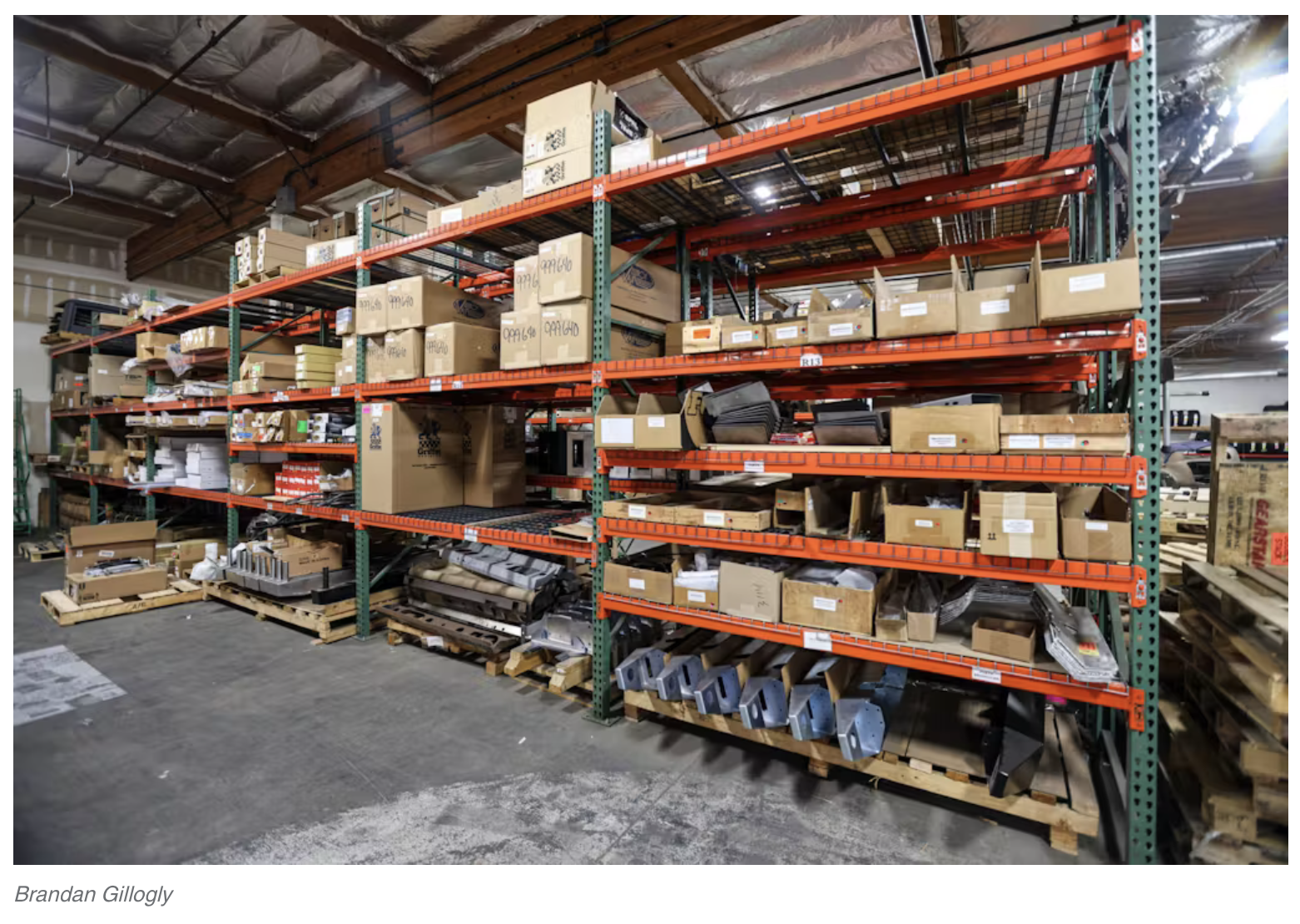

Although many parts are at this moment already in inventories and warehouses within the United States, parts prices are expected to increase if the tariffs remain in effect for long enough. This new reality is something shops across the country are having to consider. Chris Braden of Munk’s Motors, a shop in Waterford, Michigan, that specializes in European cars, especially German ones, stocks almost all the parts the shop uses on a day-to-day basis. But they won’t last forever, and they’re essentially all imported. “At the moment there’s no impact yet, but I’m kind of wondering how the prices are going to change as we replenish that stock … unfortunately they’re costs that are passed onto clients. Somebody’s got to eat that cost and it’s going to be the end consumer who ends up paying for it.”

It’s a similar story for Kent Edwards of Motorcars Ltd, a modern and classic British car specialist in Houston, Texas. “Prices will go up in the short term, and they will go up in the long term,” he says. “We buy parts from purveyors in the U.K., Germany, etc. We buy parts domestically from suppliers who import these goods from overseas manufacturers in India, Taiwan, China, Vietnam, Pakisan, Mexico, etc.” He estimates that 90 percent of the parts he uses come from an overseas manufacturer.

If the cost of parts goes up, it’s fair to assume that repair and restoration will get more expensive. Following that logic leads to a rise in the cost of insurance claims and, in turn, insurance rates.

What We Don’t Know

In short, quite a bit. Given the on-again, off-again nature of other recent tariff announcements, it’s unclear how long these automotive tariffs will last and in what form.

There are also some special cases in which it isn’t clear if these new import tariffs apply. Wealthy non-U.S. collectors can typically bring in cars temporarily for personal use in vintage rallies, concours events, or historic races, but the latest Executive Orders don’t have any clear language around that. Nor do they give any specifics regarding so-called “Show or Display,” which since the 1990s has been the main legal pathway for Americans to import vehicles newer than 25 years old.

Then there’s the matter of the rest of the world and how it will react. Retaliatory tariffs are already in motion, and cars older than 25 years may or may not be affected. There are already reports of some confusion in this regard: Several weeks ago, Canada announced its own 25 percent counter-tariff on certain U.S. goods. A Winnipeg retiree named Pat Fletcher had bought a 1968 Dodge Charger from Texas for $98,000 USD and, in March, met with the shipper on the U.S. side of the border, loaded it on his trailer, and turned north to bring it home. Border services handed him a slip of paper with an unexpected $46,636 CAD (about $32,750 USD) noted as the tariff he needed to pay; the CBC reports this was ultimately a mistake and that the car was not subject to such a high tariff. It’s now home with Fletcher in Winnipeg, but it shows how easy a mix-up can be and how quickly the goalposts are moving. Canadians looking to import a vehicle can at least find some clarity through the country’s Automated Import Reference System (AIRS), which lists the import requirements for various commodities.

Another unknown as of yet is the big question of how tariffs on cars and parts will affect prices for classic and enthusiast vehicles. Increased costs for parts and restoration may increase demand for vintage vehicles in excellent or perfect condition, as compared with similar vehicles that have mechanical needs; this would be a continuation of a trend we’ve been observing for several years now.

We’ll update this space as information becomes available.

Report by Andrew Newton for hagerty.com

![Is this the greatest racing film oat?

In “Ford v Ferrari”, one of the most important

moments comes when Ken Miles takes the GT40 out for a test run after it’s fitted with its massive new 7.0 litre V8. The scene captures a turning point in Ford’s effort to challenge Ferrari at Le Mans, with Miles pushing the prototype hard at Ford’s Dearborn test facility.

With his trademark intensity, Miles immediately feels how the car responds to the raw force of the 427 cubic inch engine. The sound, speed, and feedback through the steering wheel signal that the GT40 is finally becoming something special.

The moment isn’t just cinematic drama, it reflects real history. The big block 427 gave Ford the power it needed to fight Ferrari, and Miles’s deep mechanical understanding played a key role in shaping the car’s behavior on track.

Despite Ford pouring more than $25 million into the program, it was experiences like this, Miles sensing every detail from behind the wheel, that turned early prototypes into Le Mans winning legends.

( Media via “Ford v Ferrari” [2019] )](https://collectorscarworld.com/wp-content/plugins/instagram-feed/img/placeholder.png)