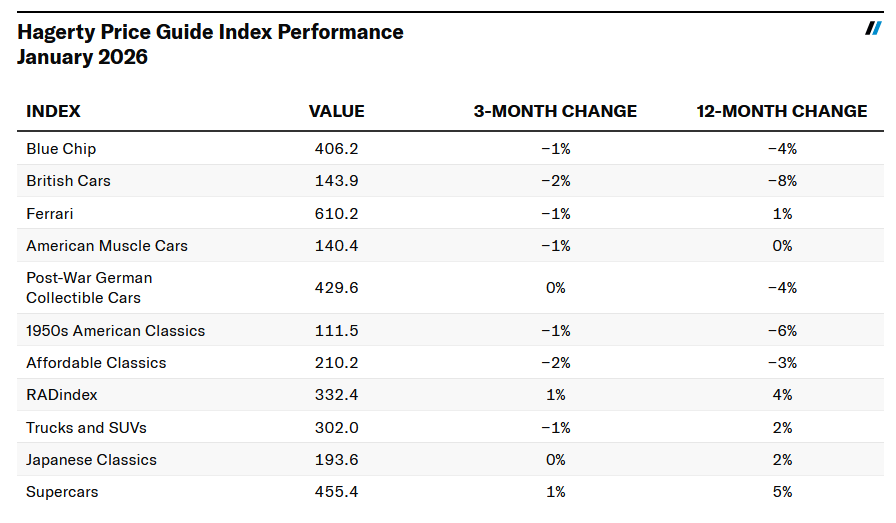

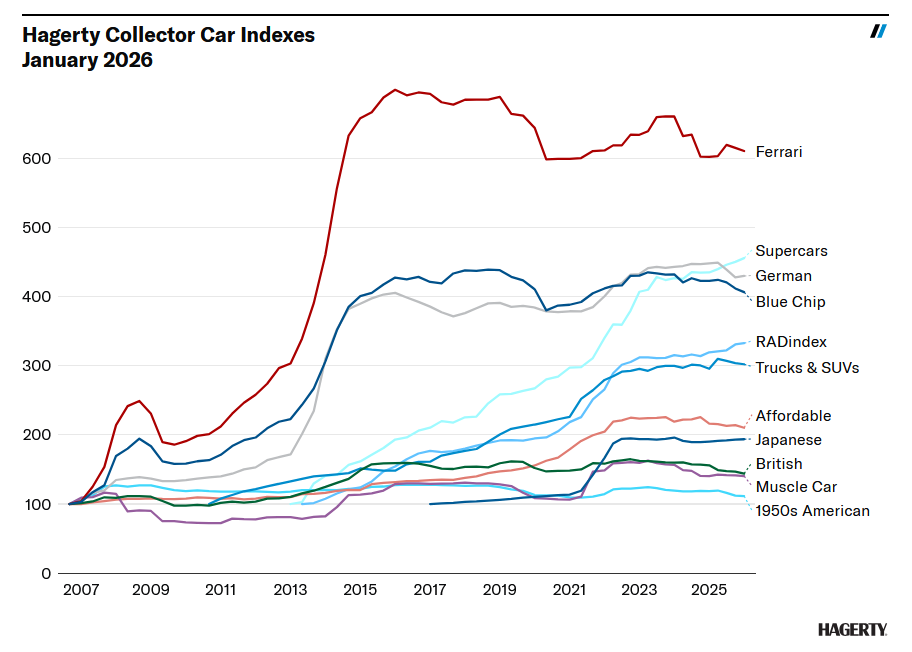

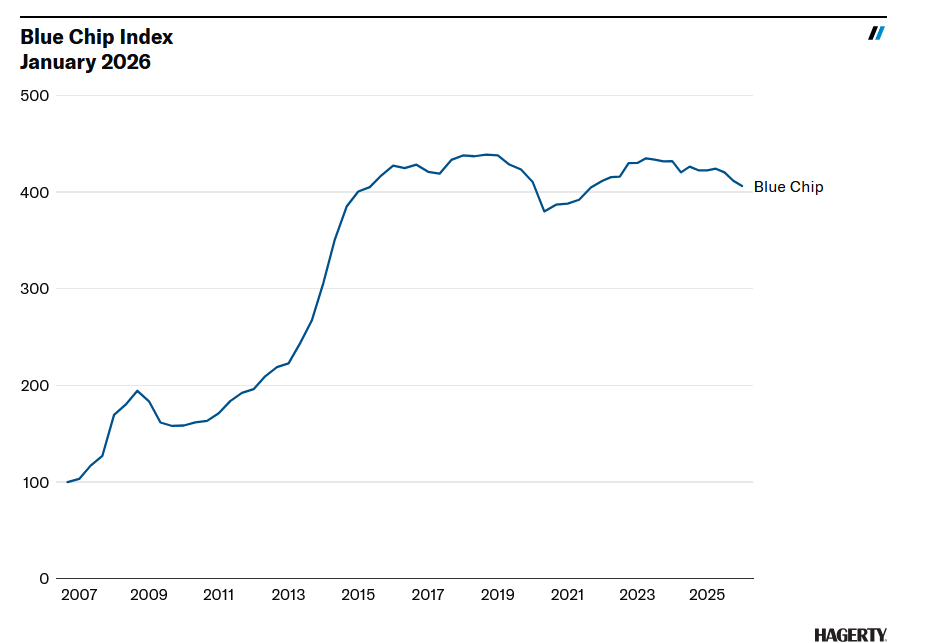

The Hagerty Price Guide Indexes—first published in 2009—are a series of stock market-style indexes that average the condition #2 (“excellent”) values of representative vehicles, or “component” cars, from a particular segment. These indexes are updated quarterly and provide an overview of how these segments of the collector car market are performing overall, as well as relative to each other.

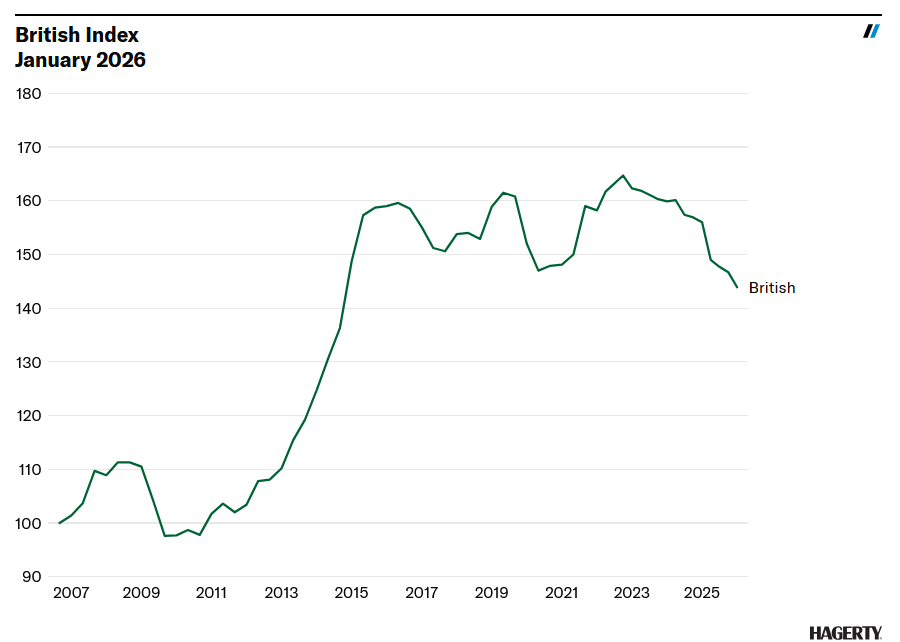

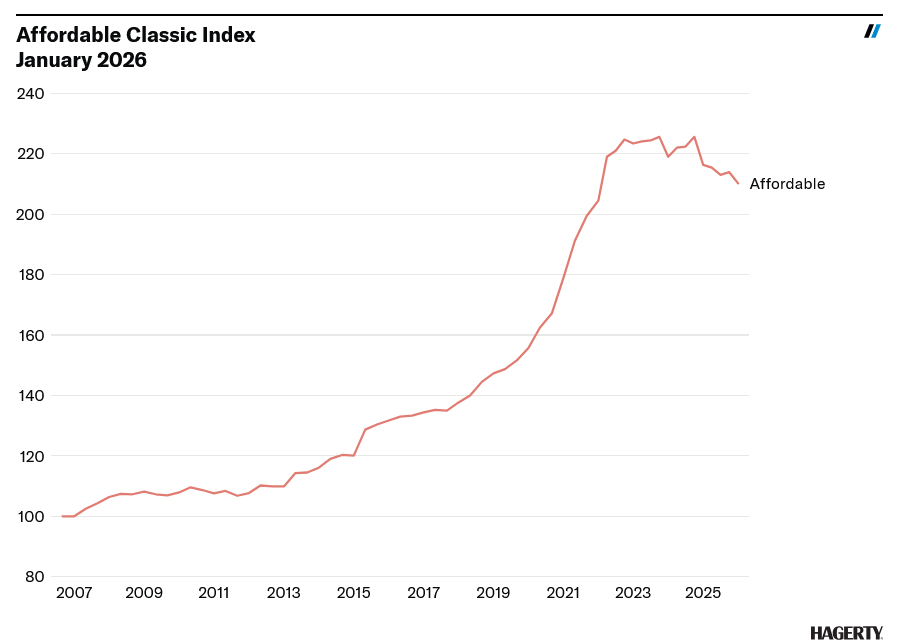

While 2026 started with a roar, Hagerty’s collector car indexes ended 2025 with a whimper. Of the 11 indexes, two moved up in value, seven declined, and two were unchanged. Movement in either direction was limited to only one or two points each, but more of the market was soft than not. This sluggishness is also apparent in the current Hagerty Market Rating and the Hagerty Hundred Index’s recent performance. The 12-month picture for our indexes is slightly brighter, with five stronger than they were a year ago, five down, and one holding firm.

Source: Hagerty Price Guide

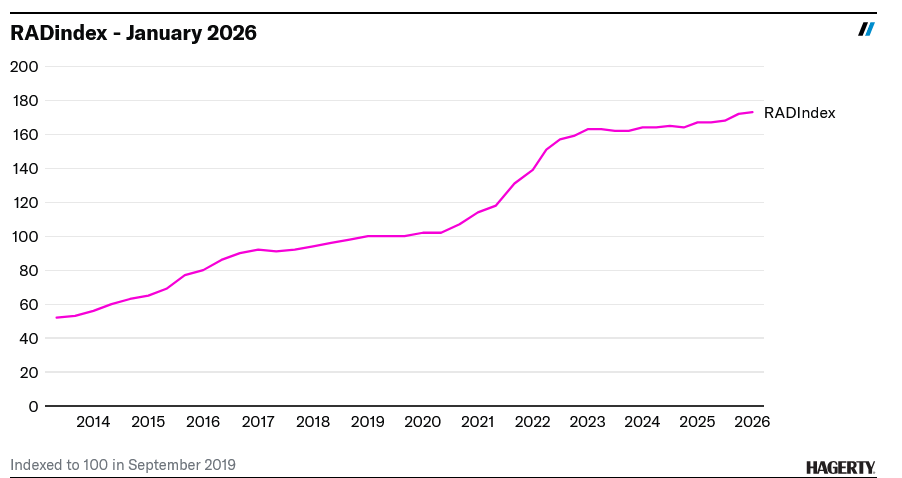

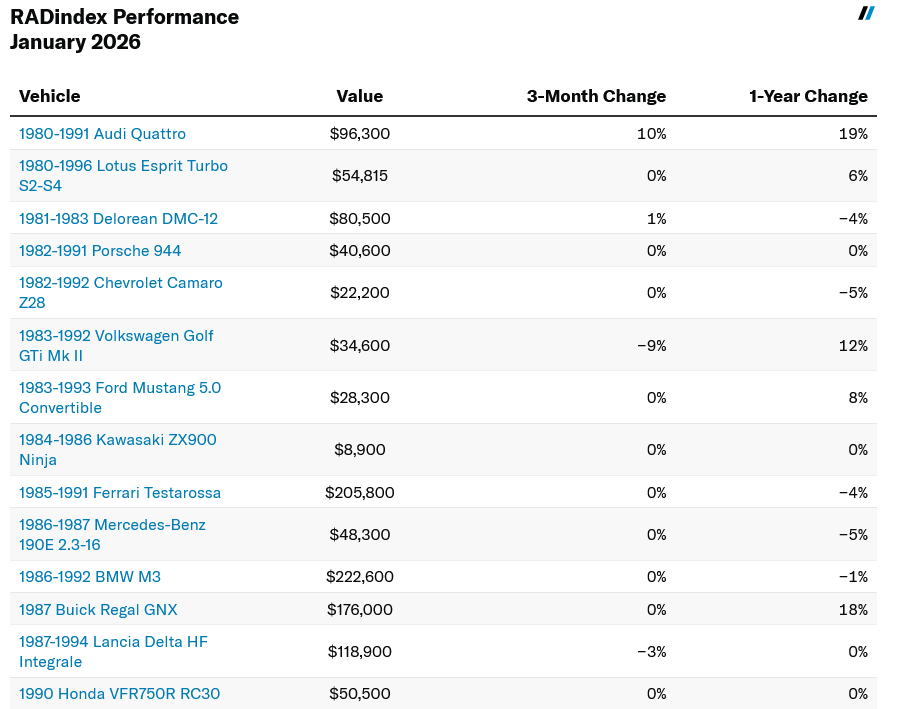

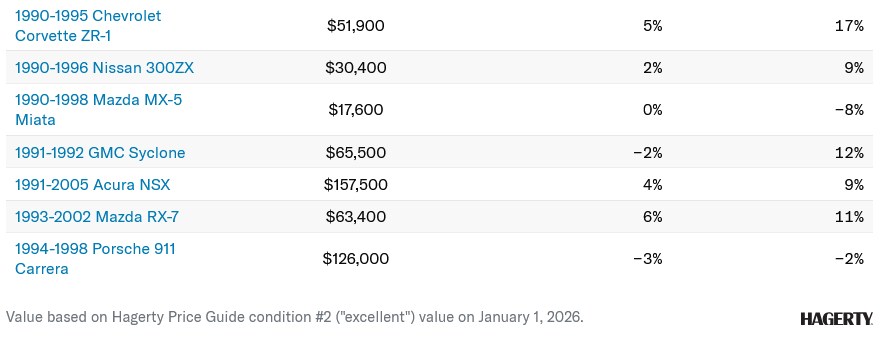

On the positive side, Hagerty’s RADindex of popular cars from the 1980s and ’90s ticked up 1%, which elevated it to another all-time high. This growth was driven by strong appreciation from the Audi ur-Quattro, the FD Mazda RX-7, and the C4 Corvette ZR-1. Nostalgia continues to be a strong factor in the market.

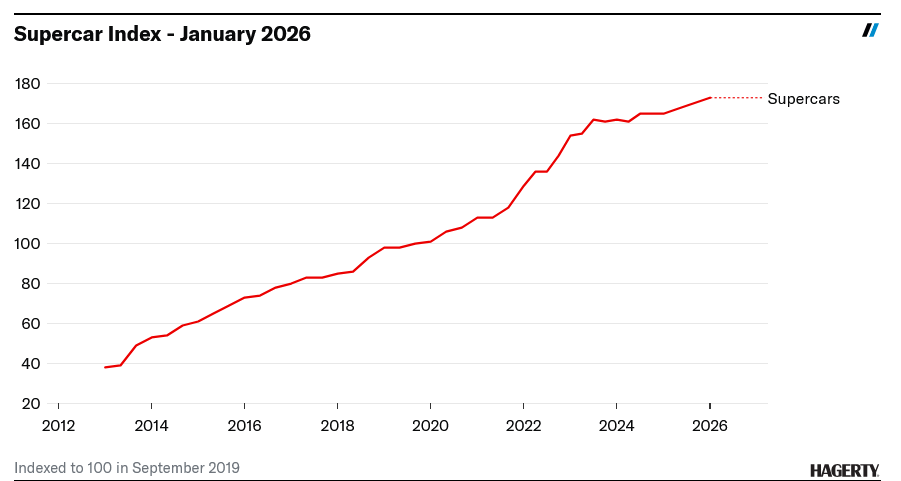

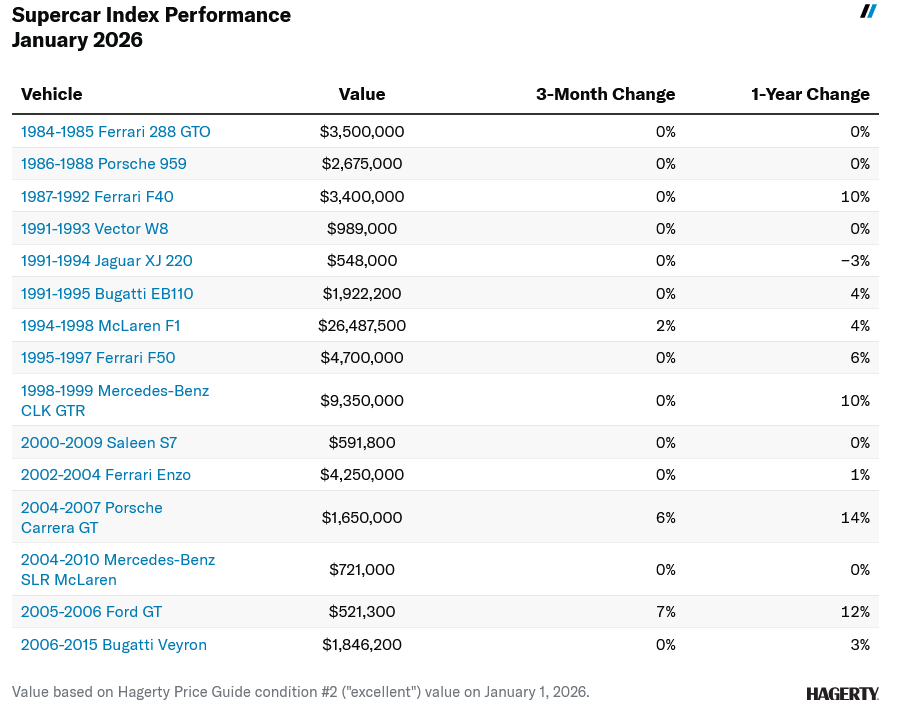

Hagerty’s Supercar Index also increased by a point to set a new high-water mark. This group of cars has been one of the strongest segments of the market over the last decade, largely due to cross-generational appeal and low production numbers. Today’s buyers seemingly have limitless options for exclusive performance cars, which could result in an oversupply in the future, but for now there are more eager buyers than there are cars available.

Other notable observations from this past quarter:

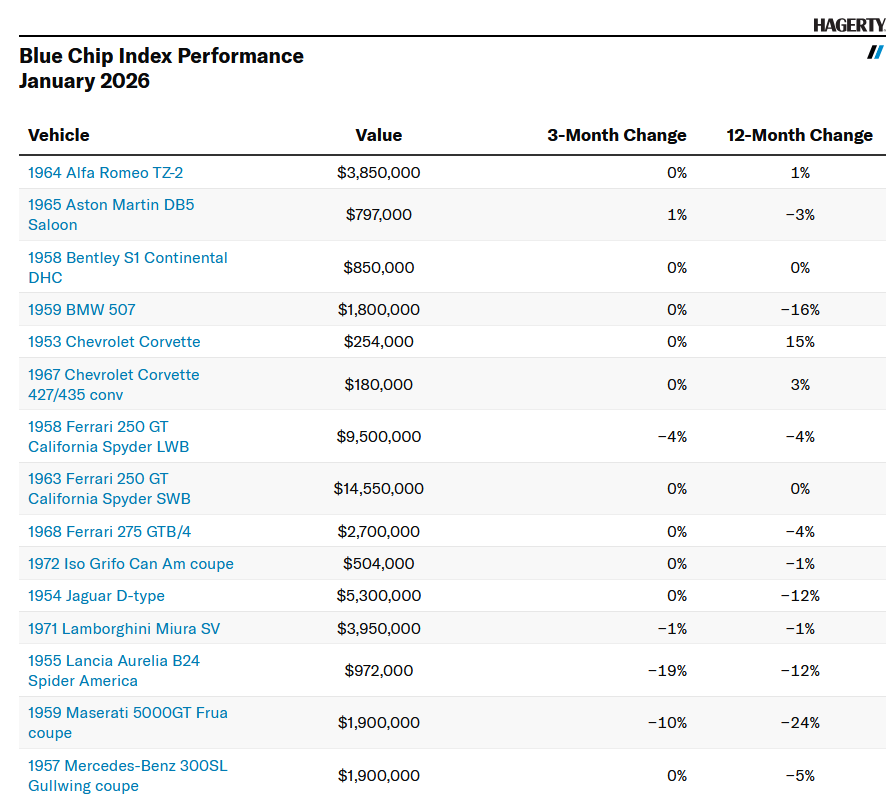

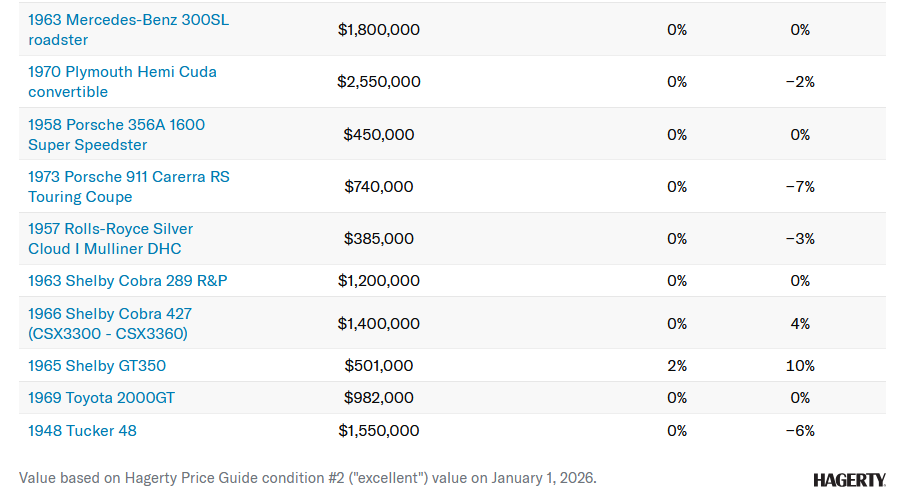

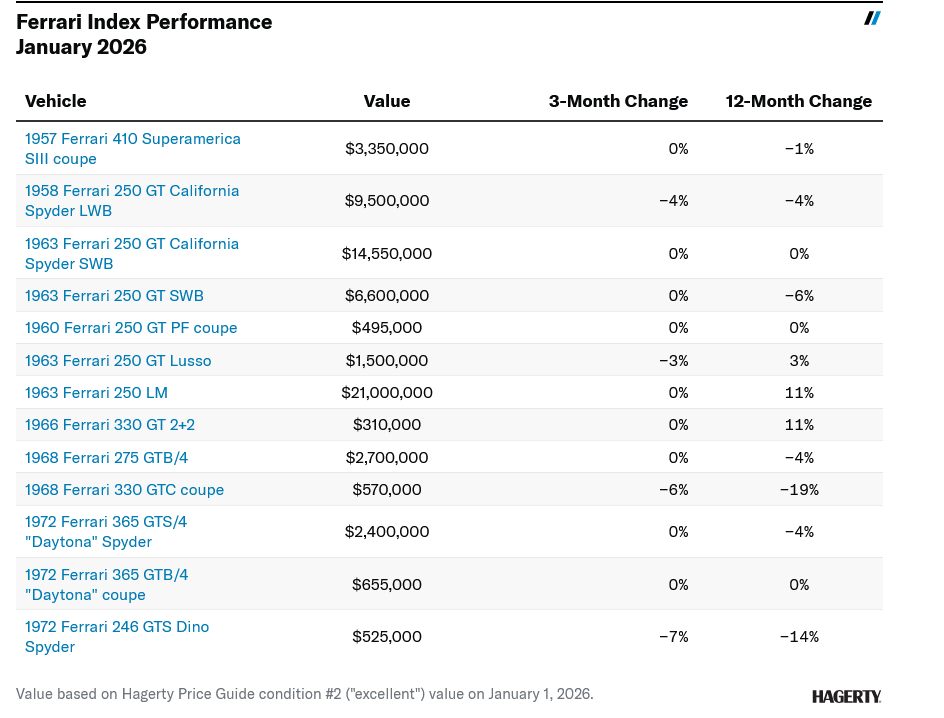

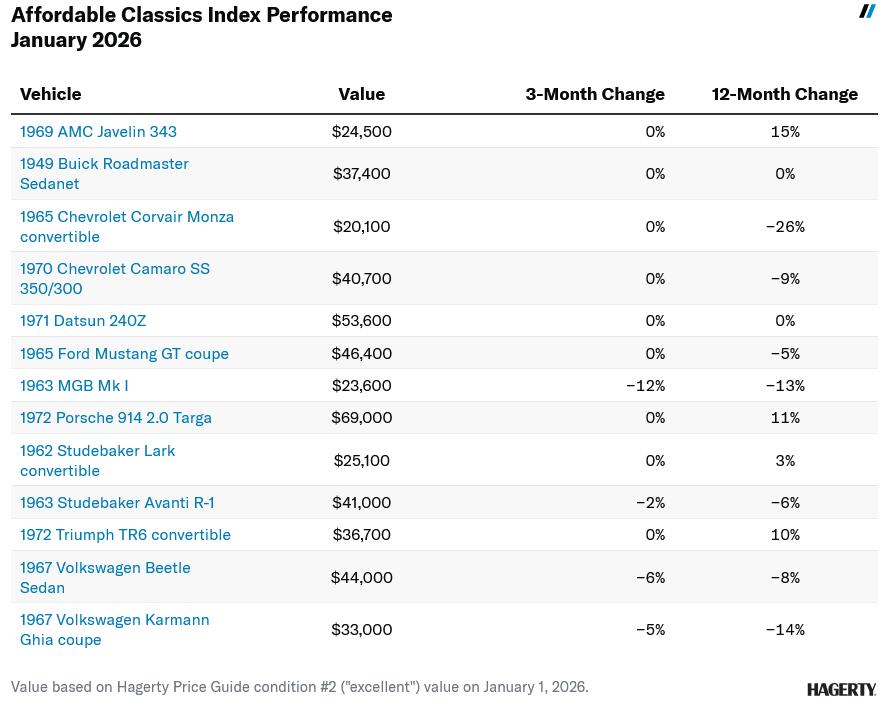

- No car in the Ferrari Index or Affordable Classics Index increased in value last quarter. Only one car from the Blue Chip Index moved up (the 1965 Aston Martin DB5, at 1%).

- Major losses from component cars included:

- 1954 Lancia B24 Spider America (-19%)

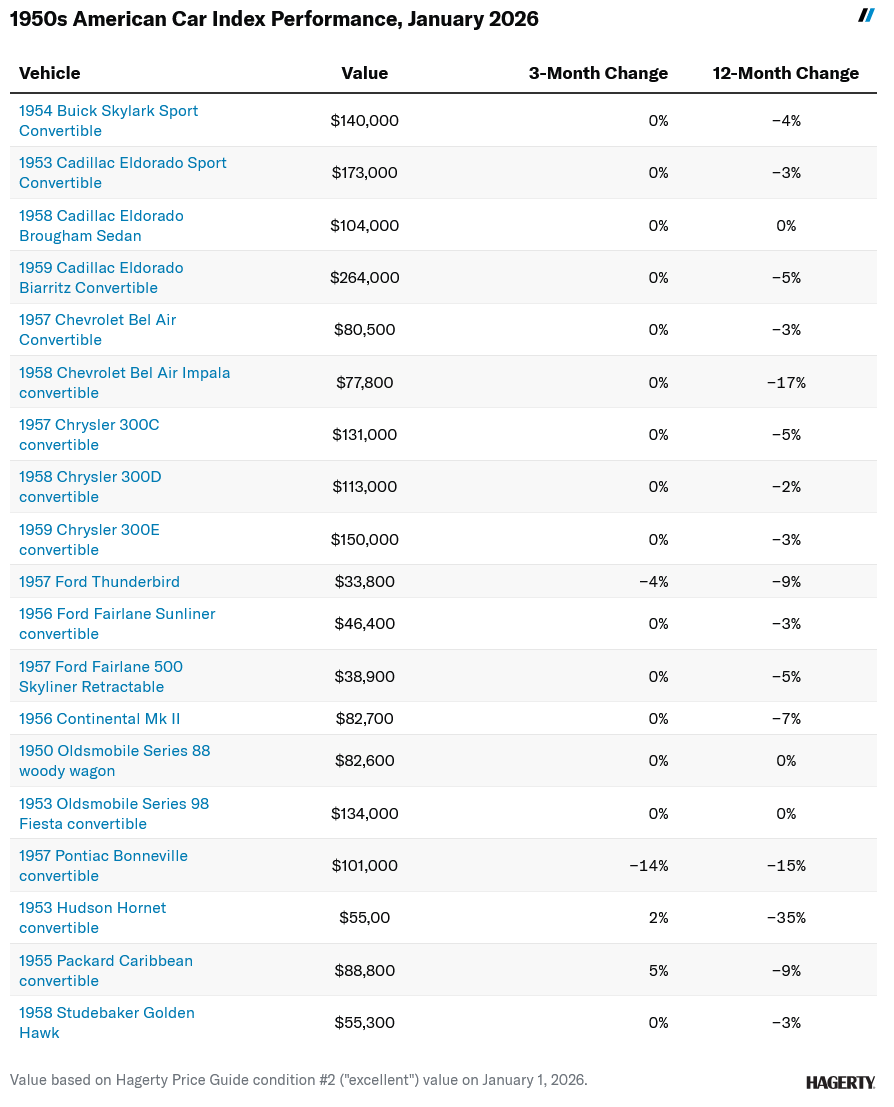

- 1957 Pontiac Bonneville convertible (-14%)

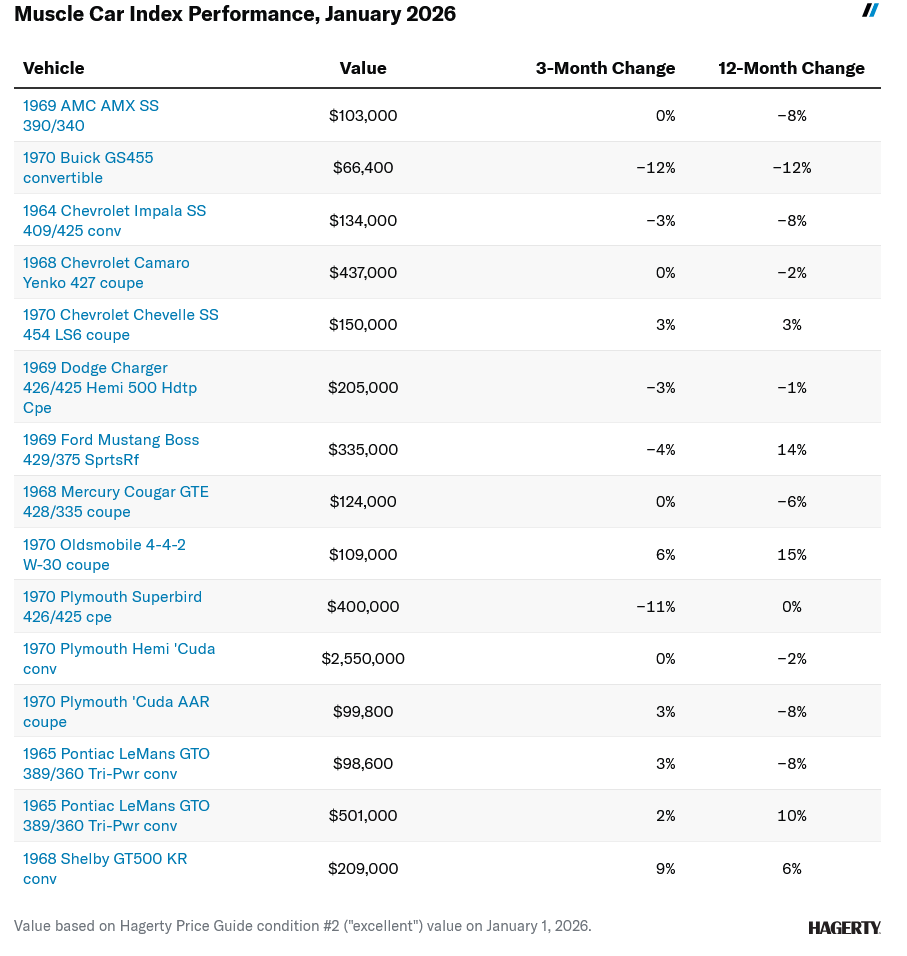

- 1970 Buick GS455 convertible (-12%)

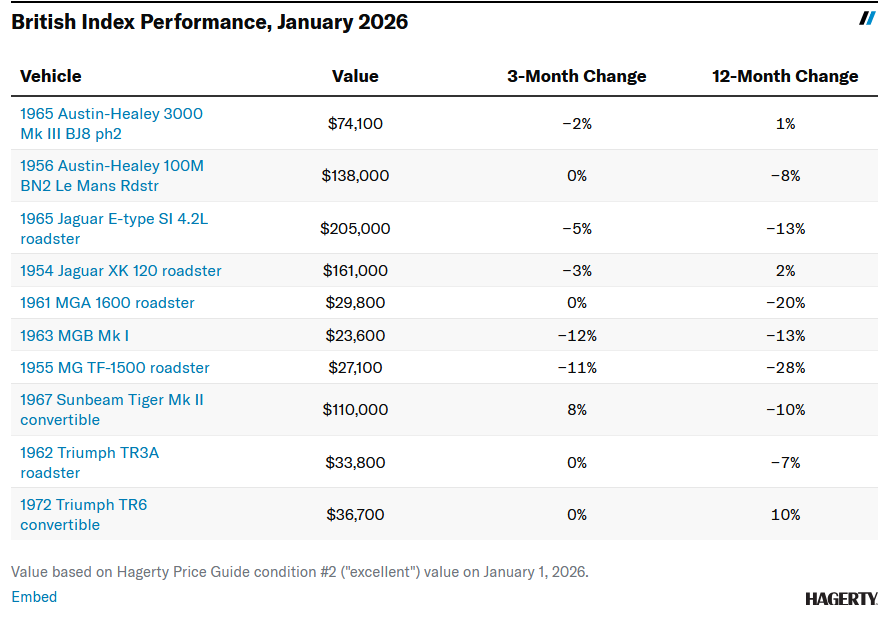

- 1963 MGB (-12%)

- 1970 Plymouth Hemi Superbird (-11%)

- MG-TF 1500 (-11%)

- Biggest gains from individual cars included:

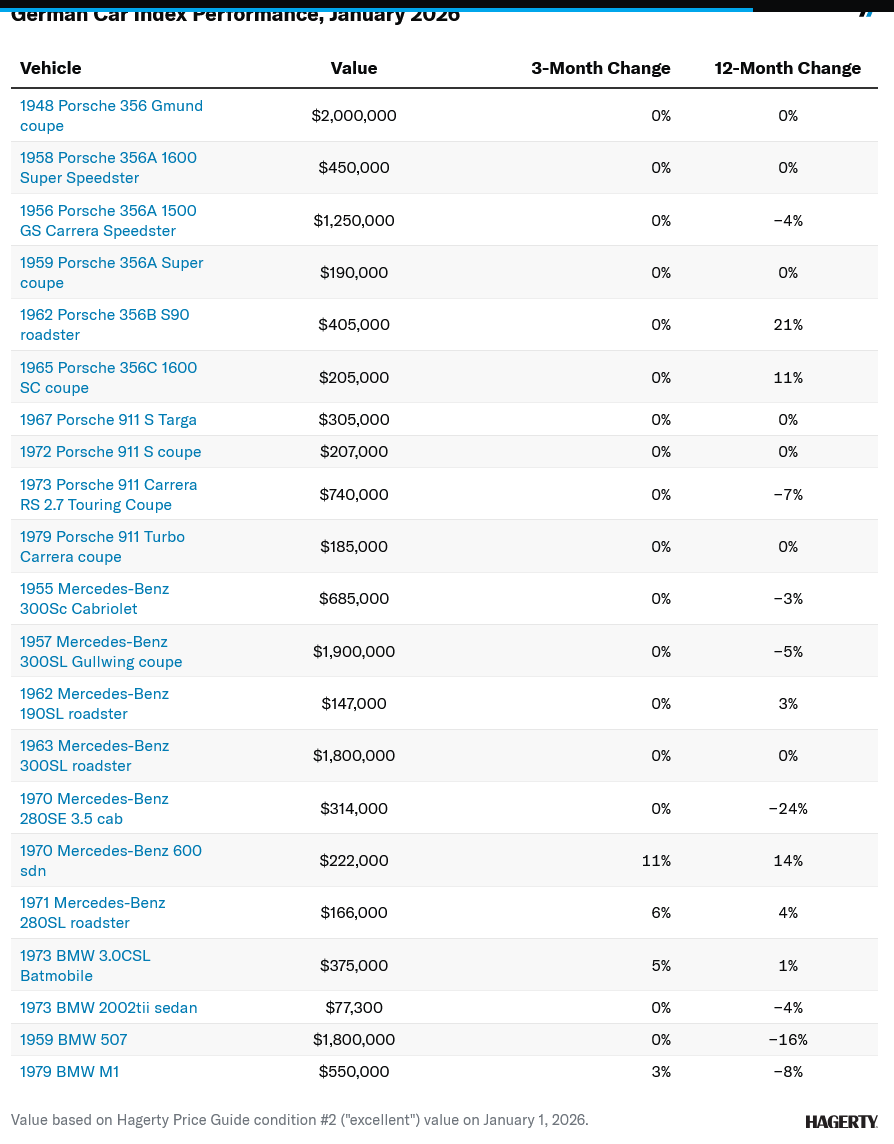

- 1970 Mercedes-Benz 600 sedan (+11%)

- 1980-91 Audi Quattro (+10%)

- 1968 Shelby GT500 KR convertible (+9%)

- 1967 Sunbeam Tiger Mk II (+8%)

- 2005-06 Ford GT (+7%)

The collector car market has never been monolithic and performance can vary greatly depending on which part of the market we focus on. January auction results—be they from Arizona, Florida, Europe, or online—illustrated that very well. There is a clear separation in price growth between old and new, affordable and expensive, premium-spec and everything else. Expect this to continue over the next few months, though not necessarily as dramatically.

Blue Chip Index

The Hagerty “Blue Chip” Index of the automotive A-List is a stock market-style index that averages the values of 25 of the most sought-after collectible automobiles of the post-war era.

British Car Index

The Hagerty Index of British Cars is a stock market-style index that averages the values of 10 of the most iconic British sports cars from the 1950s-70s.

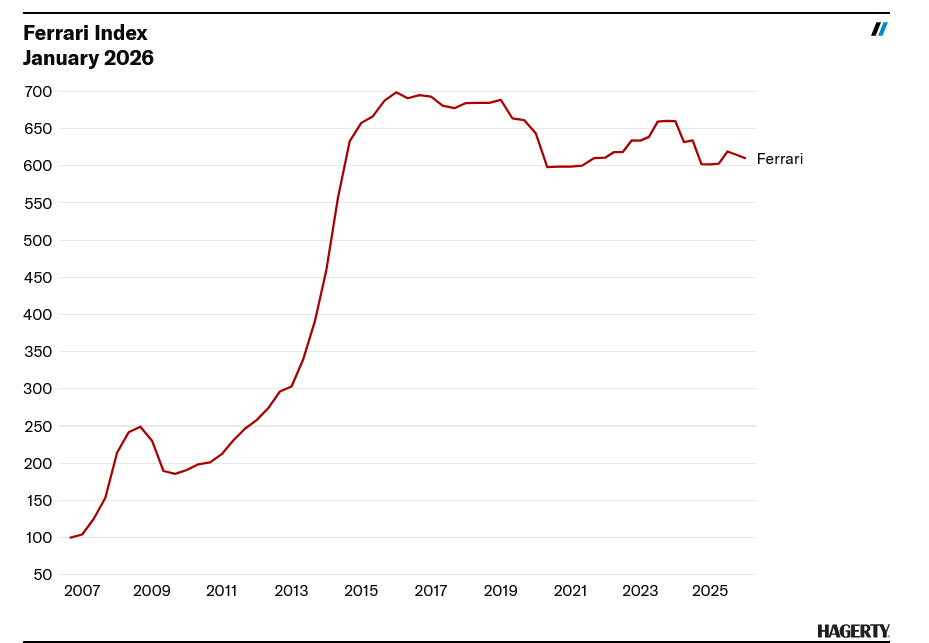

Ferrari Index

The Hagerty Ferrari Index is a stock market-style index that averages the values of 13 of the most sought-after street Ferraris of the 1950s-70s.

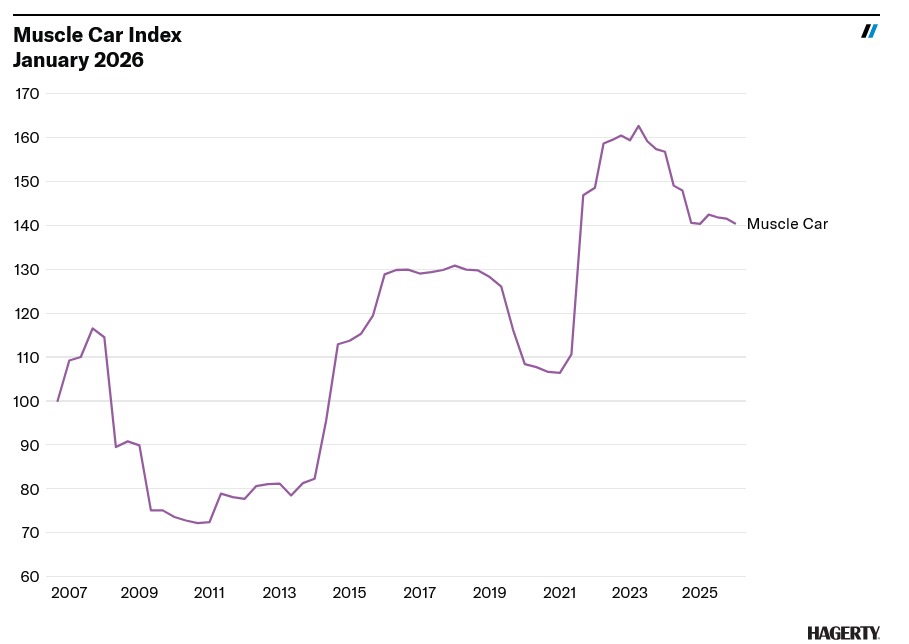

American Muscle Car Index

The Hagerty Index of American Muscle Cars is a stock market-style index that averages the values of the rarest and most sought-after muscle cars.

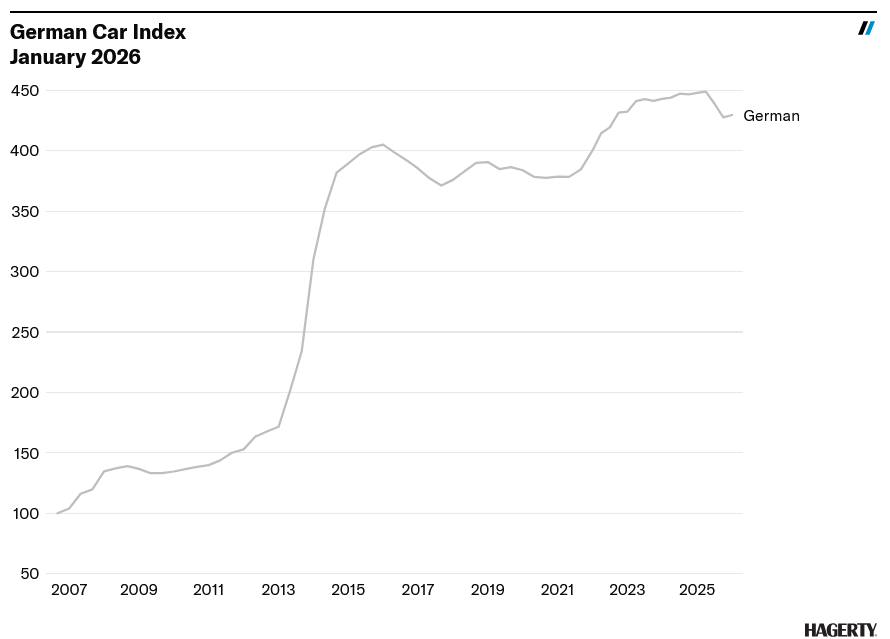

German Car Index

The Hagerty Index of German Cars is a stock market-style index that averages the values of 21 of the most sought-after cars from BMW, Mercedes-Benz, and Porsche from the 1950s-70s.

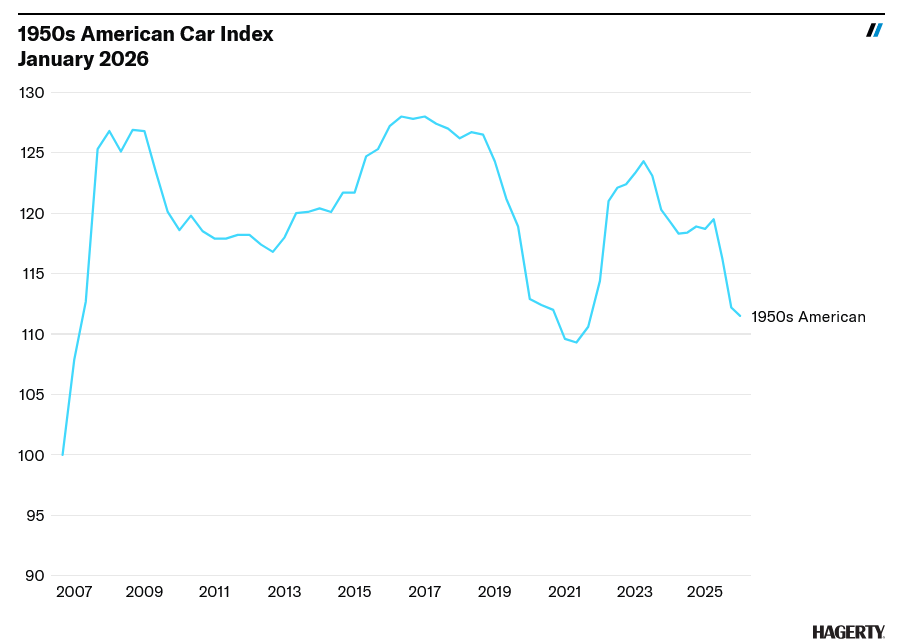

1950s American Car Index

The Hagerty Index of 1950s American Classics is a stock market-style index that averages the values of 19 of the most sought-after collectible American automobiles of the 1950s.

Affordable Classics Index

The Hagerty Index of Affordable Classics is a stock market-style index that averages the values of 13 undervalued cars, priced around $40,000, from the 1950s-70s.

RADindex

The Hagerty RADindex is a stock market-style index that averages the values of 21 collectible vehicles from the 1980s and 1990s.

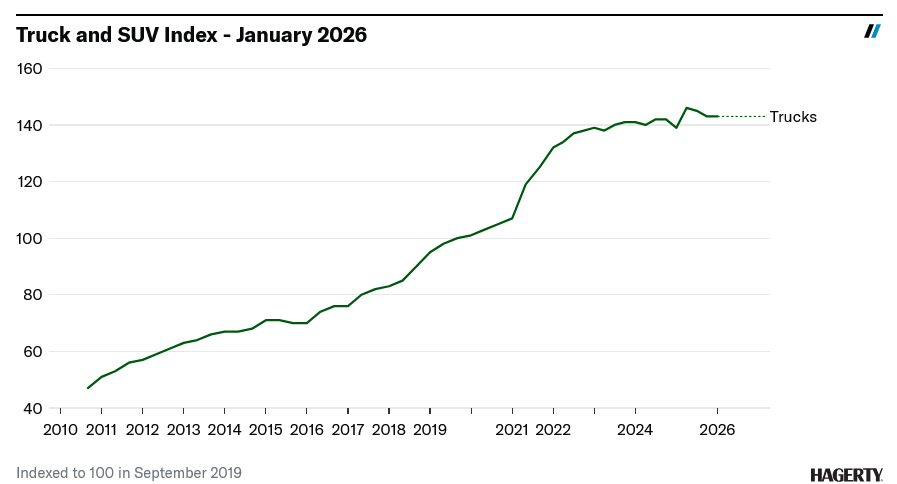

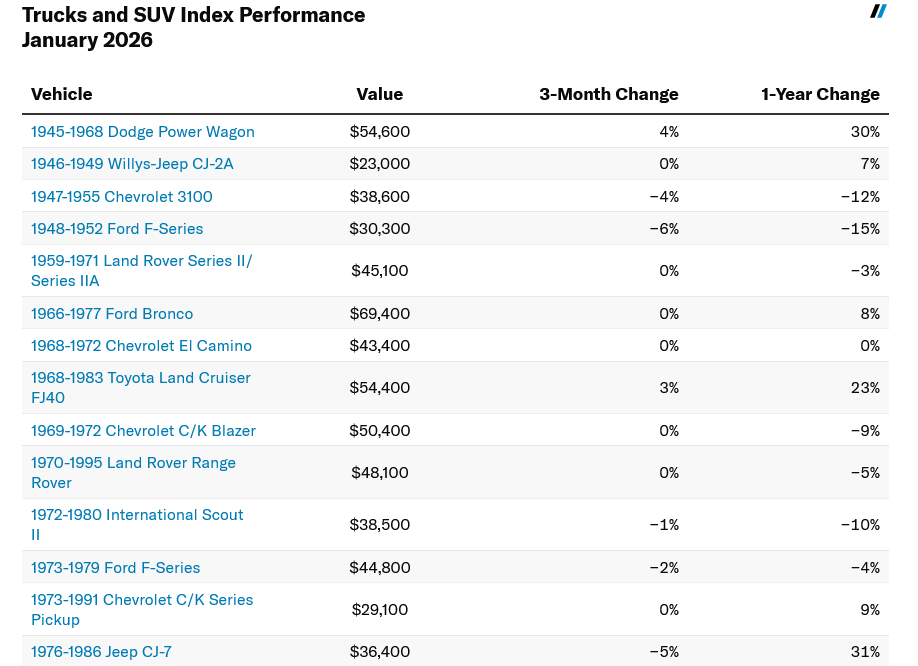

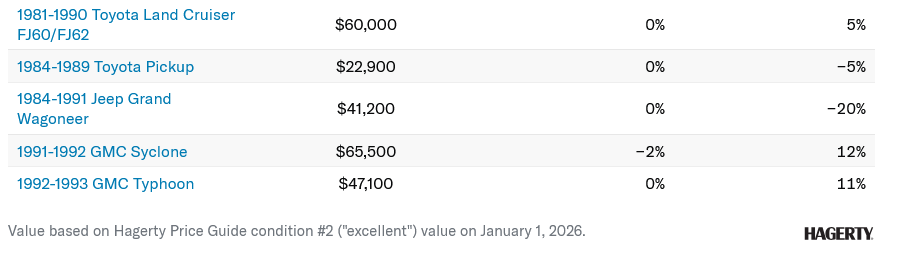

Truck and SUV Index

The Hagerty Truck and SUV Index is a stock market-style index that averages the values of 18 collectible trucks and SUVs from the 1940s to the 1990s.

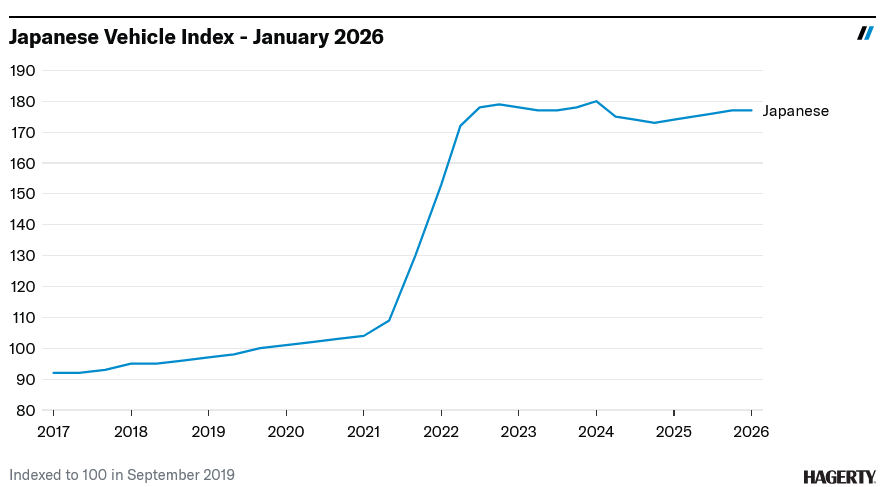

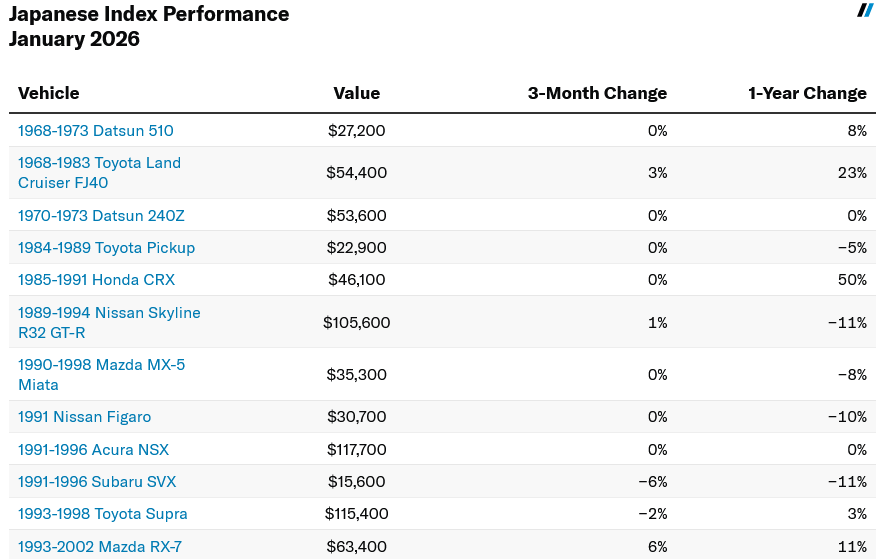

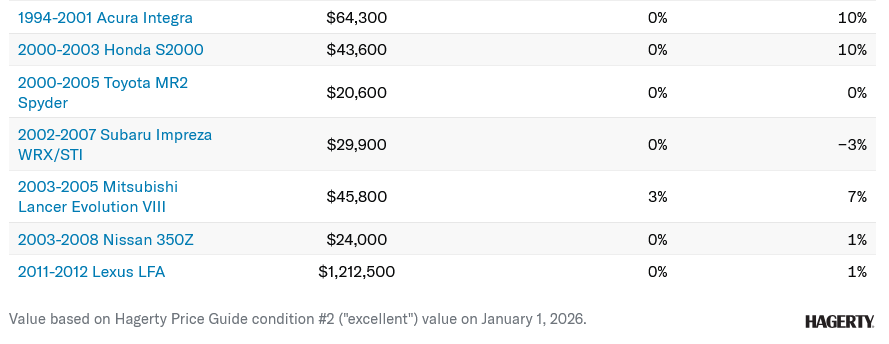

Japanese Vehicle Index

The Hagerty Japanese Vehicle Index is a stock market-style index that averages the values of 19 collectible Japanese vehicles from the 1960s to the 2010s.

Supercar Index

The Hagerty Supercar Index is a stock market-style index that averages the values of 15 collectible modern supercars and hypercars.

Report by Brian Rabold

find more news here.