There is no rigid definition of what a “hypercar” is, but to quote Supreme Court Justice Potter Stewart’s take on certain obscene materials, “I know it when I see it.” Typically, a hypercar is a mid-engined, performance-oriented, high-tech vehicle from a premium brand. It sits at the very tip-top of the automotive kingdom, not just in terms of engineering and performance but also in terms of purchase price and exclusivity. They’re beyond the supercars that the merely kind-of-wealthy drive, and fall into the realm of the ultra-rich.

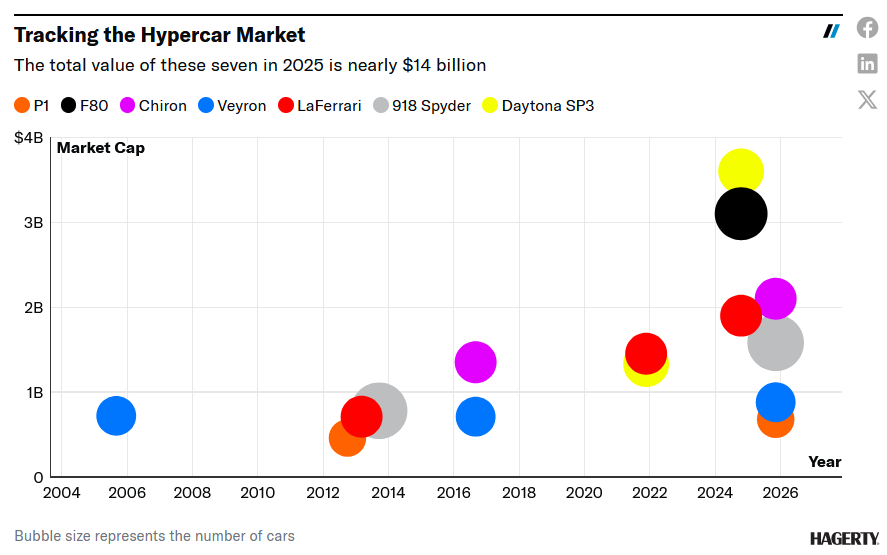

Hypercars—and the market for them—are relatively new phenomena in the history of the automobile. But they have certainly flourished over the last two decades, with more companies offering them. One might even call the field crowded, but the total value of the hypercar market continues to grow, as the graph below shows.

The size of each colored dot represents total production relative to the others. For the first appearance of each color on the graph, market share is determined by production number times the original purchase price. The market share of each subsequent dot is determined by production number times the car’s condition #2 (excellent) value in the Hagerty Price Guide, or an estimate of its price guide value based on our transactional data.

A quick tally of all the mainstream hypercars on the graph adds up to a production of only 4350 cars in total. For reference, GM sold 10 times that many Corvettes just last year. Gathered in one place, all these hypercars wouldn’t even fill half the parking garage at Disneyland (it has roughly 10,000 spots). Yet Hagerty data puts their current total value at nearly $14B, which is nearly the nominal GDP of Namibia, according to the International Monetary Fund. And there are a lot more hypercars out there now than there used to be.

At the start of the graph two decades ago, this top tier of the market was mostly limited to the newly launched Bugatti Veyron (450 built). The introduction of the hybrid hypercar trio of LaFerrari (799 built), McLaren P1 (375 built), and Porsche 918 Spyder (918 built) during the 2010s grew the segment further. Then, the Veyron’s more expensive Chiron (500 built) replacement came out later that decade, and finally Ferrari’s latest duo of Daytona SP3 (599-unit production run) and F80 (799-unit production run).

Broadly, crowding this ultra-exclusive market segment hasn’t brought prices down. On the contrary, their exclusivity—enhanced invite-only build slots and other perks—have only driven demand up. Values for the Ferraris, the Porsche 918, and the Chiron have all increased. Curiously, the two rarest hypercars on the graph—the McLaren P1 and the Bugatti Veyron—moved the least.

Outside of the mainstream cars on the graph, there are smaller companies like Gordon Murray Automotive, Koenigsegg, Pagani, and Rimac making their own hypercars and thriving. It might not be relevant to the average enthusiast or even most collectors, but the hypercar market is healthy and growing.

Report by Andrew Newton

find more news here.