Data and financial figures are central to the work featured in the pages of Hagerty Insider. Market data provides clarity, helping to determine vehicle values and track trends across thousands of transactions. Yet, at its core, this is an emotional hobby, and the industries surrounding these beloved classics are driven by people who share the same passion. For this reason, the publication regularly speaks with those who not only observe the collector car market but actively work in it, live it, and keep it moving forward.

Following an eventful first half of the year, the Hagerty Insider team sought the perspectives of industry professionals and experts to gain their insights on the current state of the market.

Healthy, Balanced, Nuanced

At the end of last year, market observers noted a general softness throughout much of 2024 and mediocre results at the Monterey auctions, but some renewed activity in the months following them, particularly the last two months of the year. As for where things stand in 2025, from our own, data-driven side of things, the Hagerty Market Rating has continued to gradually decline in 2025, and the latest release of the Hagerty Price Guide in July saw minimal movement in either direction. But those numbers don’t tell the whole story, and the pros and experts we talked to added some nuance and context.

“I’ve rarely seen a market that’s been searching for direction as long as this market has been,” says Dave Kinney, founder of US Appraisal and publisher of the Hagerty Price Guide. With factors varying from parts costs to interest rates and general economic uncertainty, “people are just being a little more cautious with their money,” he notes.

Other experts have mixed observations. “A lot of people are struggling to find inventory, and there are a bunch of factors resulting in fewer buyers,” according to Derek Tam-Scott, co-founder of OTS, a collector car dealer in Berkeley, California. “There’s just some number of people who can’t participate [in the market] right now because of interest rates or economic uncertainty and they just don’t feel comfortable buying.” The top end of the market, he notes, “is ripping right along,” and overall feels that there is more balance between buyers and sellers across the market. “It’s in a more healthy, sustainable position, certainly.”

Harald de Bruijn runs Fourwheel Trader, a YouTube channel that specializes in depreciation analysis of sports and supercars that range from new to about 20 years old. For the cars he tracks, “the market strengthened slightly compared to the end of 2024. The year-over-year price change is less negative than before. This is in line with the long-term trend; peak value loss occurred in the second half of 2022. Since then, price changes have been increasingly less negative.”

The past six months were a bit of a “rough ride” for Jose Romero of DriverSource, a collector car dealer in Houston. But a large part of that was getting rid of old inventory—”stuff that corrected, and we had to swallow those losses and move on.” More recently, however, inventory has been moving better, and “I think the market’s healthy overall, with a lot of activity.”

“Healthy,” along with “resilient,” are also words that Adolfo Massari uses to describe the market at the moment. Massari co-founded LBI Limited and recently co-founded another dealer, Animoya Garage, in Pontiac, Michigan. He notes the “tariff roller coaster ride that ushered in a new era of uncertainty” (more on that below), but also adds that navigating all of that has been manageable, and that “the consistent sentiment we have here is one of optimism, and many of our colleagues and clients share that same outlook.”

On the auction scene, “prices are down, but prices were pretty enthusiastic a while ago, and so coming down just means that they’ve returned to a more reasonable level,” says Rick Carey, who has been covering the auction market since the early 1990s. “People are not paying what the presale estimates on the cars suggest they should, but I think this is a case of the auction companies pandering to clients by taking cars with modest reserves and setting excessive estimates in hopes of getting someone to spend that much money.”

Barney Ruprecht, VP of Auctions at Broad Arrow, also notes the “uncertainty” felt in the world generally, but contends that “it seems as if there is less uncertainty in the collector car market right now” compared to the end of 2024. “Overall collector sentiment remains positive.”

Economic Jitters, and the T-word

We heard “healthy” and “positive” quite a bit, then, but you might have noticed “uncertainty” a few times up there, too. Tam-Scott pointed to “people who are sitting it out right now because they’re uncertain or concerned, which is understandable given how much things are changing right now.”

“I’ve seen prices of supplies and parts go up and down in the last six months so much, it’s been hilarious,” says Kinney. “Wall Street’s learned to kind of adjust to things with the tariffs and not take it too seriously, but on the micro-level it seems like everybody’s being cautious.”

John Temerian, founder of the Miami supercar dealer Curated, also pointed to uncertainty, but mainly to point out that it hasn’t much disrupted the 1990s-2000s analog supercars he typically deals in. “This niche market appears immune to broader economic jitters” since it’s “driven by passion and scarcity rather than short-term speculation.” While he admits that broader economic pressures have “certainly added a layer of complexity and stress” and that “some collectors have become more cautious, many are doubling down on ‘forever’ cars that are truly irreplaceable.”

Of course, a big element of the uncertainty and economic jitters are the evolving nature of U.S. tariffs since the first major announcements in the spring. Collector cars trade across borders all the time, so buyers and sellers were paying attention. And it wasn’t exactly clear what they should do.

“When the whole tariff thing came up, initially there was kind of a shock and awe where we didn’t know what was going on,” says Romero. “I had some clients that had cars abroad that paid a stupid amount of money to fly their cars back over the next day.” They didn’t want to get stuck with a surprise tariff, which, on a multi-million dollar car, could have been huge.

Massari also notes that clients rushed to air-freight cars back to the U.S. after tariffs were announced to get them in before the deadline, when the normal 2.5% tariff would see an extra 25% added on top of it. His own business acquired a Porsche in Germany, and he wound up keeping the car at the port until it was later announced that the 25% tariff hike would not apply to cars 25 years or older.

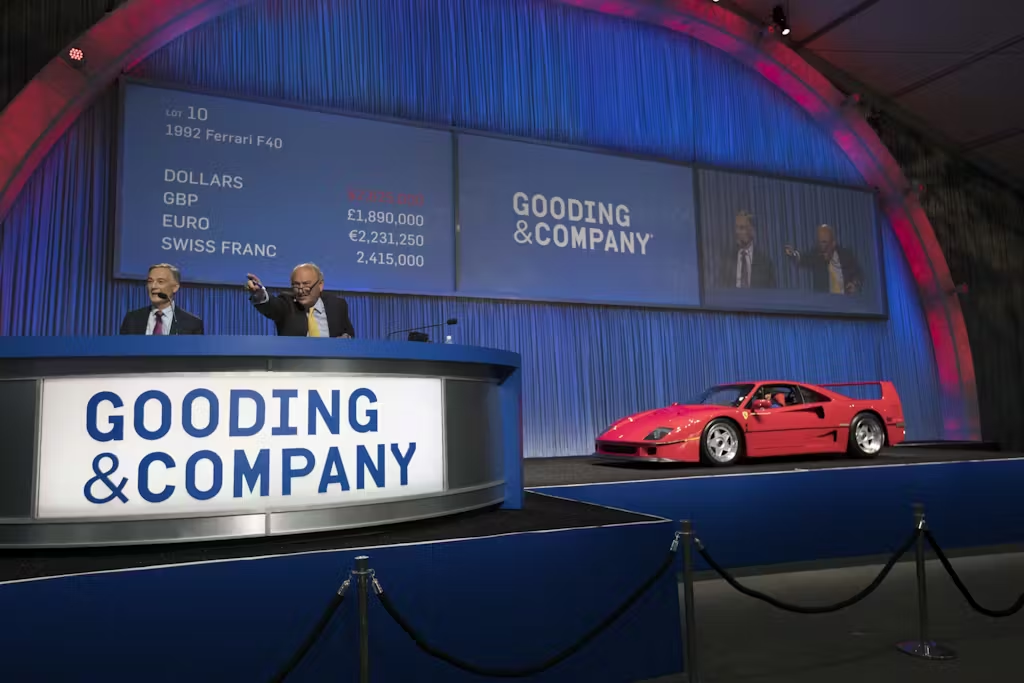

Tam-Scott has a similar story with a Ferrari: “We had an F40 that was out of the country that we needed to get in, but they were finishing work on it and it couldn’t leave yet. The tariffs were supposed to go into effect on April 2, so we were running around like mad trying to get the thing into the U.S. before then. But then all of a sudden they announced that cars over 25 years old would be accepted [without the new 25% rate]. So we went through all that trouble for nothing.”

Our market observers had different observations on the tariffs. Temerian called them a “roller coaster ride for both the collector car and modern supercar market,” and Massari notes that “tariffs have certainly changed the way cars are being traded … our clients are now a bit more wary and cautious about acquiring cars overseas.” Ruprecht also made the important distinction on tariffs between classic (25 years or older) and newer collector cars, as the newer ones are subject to higher tariffs: “Those looking to buy new cars from retail dealers are hitting pause before automatically taking the latest and greatest ‘instant collectible’ supercar offerings … I predict the new car market will slow down.”

For Romero, meanwhile, “the dust has kind of settled” on tariffs. “I don’t really hear many concerns about them,” he says, adding that DriverSource has had healthy business recently from clients in Canada, Mexico, and Brazil.

As for cars trading between the U.S. and Europe, “there was a point in time in the fall of last year where the euro was almost on par with the dollar,” says Massari. “The favorable exchange rate brought an influx of imports into the U.S., but now, the dynamic has reversed, and we are seeing more of our cars go overseas due to the strong euro.” Tam-Scott has a similar view on the exchange rates: “There’s a lot of cool stuff that we’d like to import, but the numbers no longer make sense. The weakness of the U.S. dollar right now is really a bummer.” And so does Romero: “We get offered cars all the time from Europe, and I’m not actively buying them unless it’s a super-special, rare car that makes sense for us to buy.”

The fewer opportunities between the U.S. and Europe may also be down to something Temerian observes: “There used to be a delta between the European supercar market and the U.S. market,” but now “most great supercars are the same value on either side of the Atlantic.”

What’s Hot, and What’s Not

“There are segments that are doing well and there are segments that are doing less than well right now,” says Kinney. “But that’s just the way markets work.” Specifically, he sees continued strength in the JDM and “JDM-adjacent” market, referring to LHD, U.S.-market versions of ’90s Japanese favorites like the FD-generation RX-7 or Mk IV Toyota Supra.

Nearly all of our market observers pointed to strength in the Porsche market. “Air-cooled Porsches and early water-cooled generations continue to be extremely desirable,” says Massari. “997.1 and .2 GT3 RS and RS 4.0L, and GT2 RS have skyrocketed.”

It’s not just factory Porsches that are hot, as several pointed out surprising prices for cars built by RUF, the famous German manufacturer and Porsche tuner. “RUF is really something that has seemingly grown overnight,” says Ruprecht, noting two high-profile auction results for early RUF “Yellowbird” models earlier this year. “Looking back to what the previous CTR 1 Yellowbirds sold for and their market value today is remarkable.” Massari thinks this has implications for other genres of cars as well: “The interest in RUF Porsches and Singers is still very high, which has opened the door for other companies looking to restomod or ‘reimagine’ other marques. Cars that are tasteful, high-caliber builds are doing exceptionally well.”

Like others, de Bruijn also sees that “most sports cars from Porsche are doing extremely well value-wise.” Other newer cars he watches that have surprised him with prices either staying flat or going up include third-generation GT500 Mustangs, Alfa Romeo 4Cs, Ferrari F12s and Superfasts, and the current-gen 3.0L Toyota Supra. “The Supra has been mostly flat during the last year. This is remarkable given the age of the car. It is too early to call it a bottom but definitely worth monitoring.” He also notes that despite significant updates and mostly positive reviews in the press, the latest crop of Aston Martins still depreciates like, well, Aston Martins. “Prices still fall quicker than for most peers.”

Speaking of Astons, Massari notes that “British sports cars from the ’50s and ’60s were a bit flat the last time we spoke, but we see the tide turning a bit on some of the more iconic models like the E-Type, Aston Martin DB5, and a couple of others. MGs and Healeys, not so much.”

Most of the experts noted strong prices for almost every modern analog supercar, and both Temerian and Tam-Scott also mentioned huge demand for Lamborghini Diablos, particularly rare variants like the SE30 and the Diablo GT. But one general trend across market segments is something that we’ve touched on in several of these market roundtables: Condition matters more than ever, and so do options and colors.

Picky Buyers, New Buyers, and Changing Tastes

“Every dealer that I talk to, without exception, says that if it’s not a perfect or damn-near-perfect car, it’s having a hard time selling at any price,” according to Kinney. One dealer even told him that “I’ve had buyers reject old British cars because they had a leak!”

The dealers we talked to expressed similar sentiments, with several pointing out that fewer people are attempting projects. For Romero, it sounds like the magic of “barn finds” has certainly worn off: “It used to be we could buy a barn find/garage find type of car, and if we bought it right we knew a few guys we could sell it to as-is for a quick flip and be done, or we could prep and service and clean it, get the books and tools and all that stuff, and then really hit a home run with it. But now you can’t sell those kinds of cars in the current state they’re in anymore. Those buyers are gone.”

Romero also notes that many older, more seasoned collectors who had been resistant to late-model cars like Ferrari 360 Challenges or 550 Maranellos are now coming around to them, while Temerian points out that “while core collectors remain active, we’re seeing a younger and more global audience stepping in—especially savvy buyers from the Middle East, Europe and parts of Asia who are less phased by economic headwinds.”

Regardless of where they come from, though, buyers are willing to pay up for the rarest specs. “Across the board, there’s heightened discernment to spec and rarity, and nowhere is that more evident than color … this year, the premium has reached unprecedented levels. A truly unique PTS [paint-to-sample] Porsche or out-of-range Ferrari spec can now bring 50-100% more than something standard,” says Temerian.

Several of the market observers pointed to social media fueling the popularity of cars like Diablos and paint-to-sample Porsches, but Tam-Scott has observed that “the baseline level of knowledge people have about the cars seems to be a little lower. You get less savvy buyers, you have to explain things to them a little bit more … now there seems to be a little bit of clout chasing with people saying ‘oh, I heard these are cool and my friends have these,’ or they’re not buying it because they know the history of the company or they really like the philosophy or even the experience. There’s more of a sort of casual interest that gets exercised in the form of buying something out of curiosity.” He notes that this kind of feeling is particularly strong among Porsches, “but for obscure stuff, like Lotus Sevens or anything British with carbs and wire wheels, that’s not really playing out that much. It depends on what the car is.”

Millennial buyers becoming a larger force in the market is a constant trend that has continued into 2025, and has naturally pushed the strength in prices for 1980s and newer collector cars. And while these buyers increasingly pay up for the best options, colors, and condition, and more easily move past lesser examples, Tam-Scott has noticed one area where younger buyers aren’t so picky: “Periodically I’ll see a variant of a car that’s an automatic that I would never want with an auto, like a Tiptronic 964 or 993, and it will sell for a stupidly high number. I think that’s a reflection of a demographic shift. There are just enough people out there who don’t know how to drive a stick but still want an air-cooled 911—If there are enough people like that, it makes the values of those cars go up, which is baffling to me, but maybe it makes sense given the way things are shifting.”

Looking Ahead

The next big heat check for the market, particularly the higher end of it, is at the Monterey auctions in a few weeks. And there is some optimism there, even after the soft results in Monterey last year. “I expect that it should be a good auction in August,” Kinney contends. “My assumption is that the auction companies have adjusted their pricing structure so that they’re taking more cars with no reserve and more cars with very realistic reserves.” Carey feels similar: “With less than a month from Monterey, I think things look pretty good on balance.”

Massari, meanwhile, will be watching Monterey to see what happens with Enzo-era Ferraris. “They were a little flat when we last spoke, but a few recent sales give some indications that they may be poised for appreciation … With the upcoming Monterey auctions, each auction house is chock-full of them so it will be interesting to see what comes of their values.”

Romero points out, though, that these “heat checks” of the market aren’t as important as they used to be: “It used to be we have the Scottsdale auctions in January, Amelia Island in March, and our Super Bowl in August at Pebble Beach. Those were the three times a year you really got a sense of the market. But it’s year-round now. It’s in the palm of your hands with all these auctions going online. You’re always getting comps.”

Looking past Monterey and beyond, we come back to one of the challenges facing the industry, and it’s related to the shift in buyer preferences we’ve outlined above and in past roundtables. Restoring and servicing cars is becoming harder and more expensive. “Not only is the cost for restoration higher because of the parts, but also the talent is quickly disappearing,” says Kinney. “Sadly, it probably means more cars are going to enter the market as parts cars or become parts cars, even though they’re potentially restorable.”

“We have some customers who aren’t in a major city, and they’ll say ‘I don’t have anybody around me that can work on this thing, and there aren’t any shops around me,” says Romero. “Even here in Houston, if I have some oddball car, there’s nobody to work on it. And then some of the shop prices that some of these guys are charging … it’s gotten so ridiculous that I think people are shying away from that.” He adds that DriverSource has an ad out for mechanics year-round, and they just hired an additional four.

“Part of it is cultural, but people aren’t attempting projects,” adds Kinney. There’s the cost of all the supplies, including chrome, paint, and everything else, but the father-son or father-daughter restoration team, they’re just not out there anymore.”

That said, the overall outlook on the market going forward among observers was positive, and several noted that there are deals there are far more opportunities to find deals today than there were just two or three years ago. It’s more of a buyer’s market today, and regardless of what the market is doing, the best advice in this hobby is always to buy what you love.

Report by Andrew Newton

find more news here.