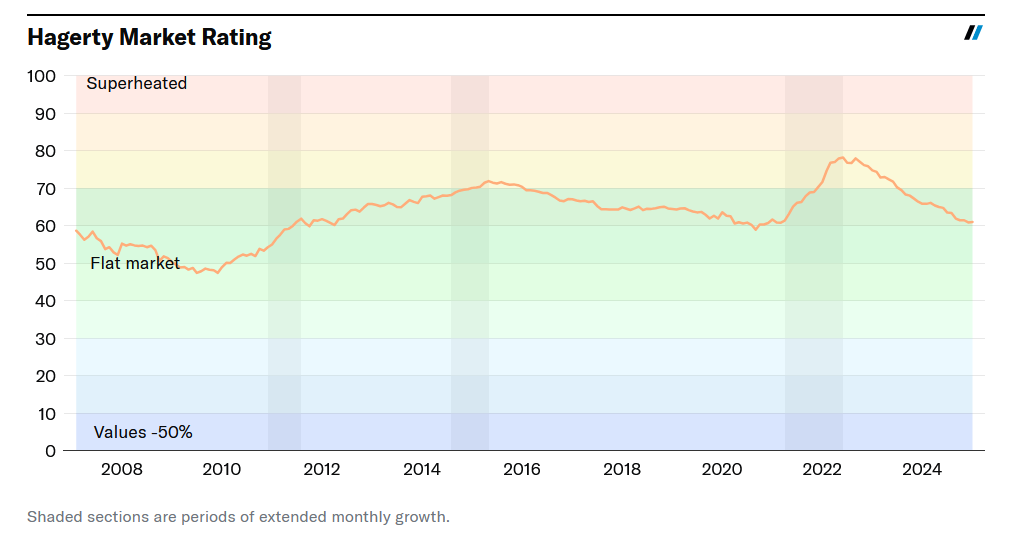

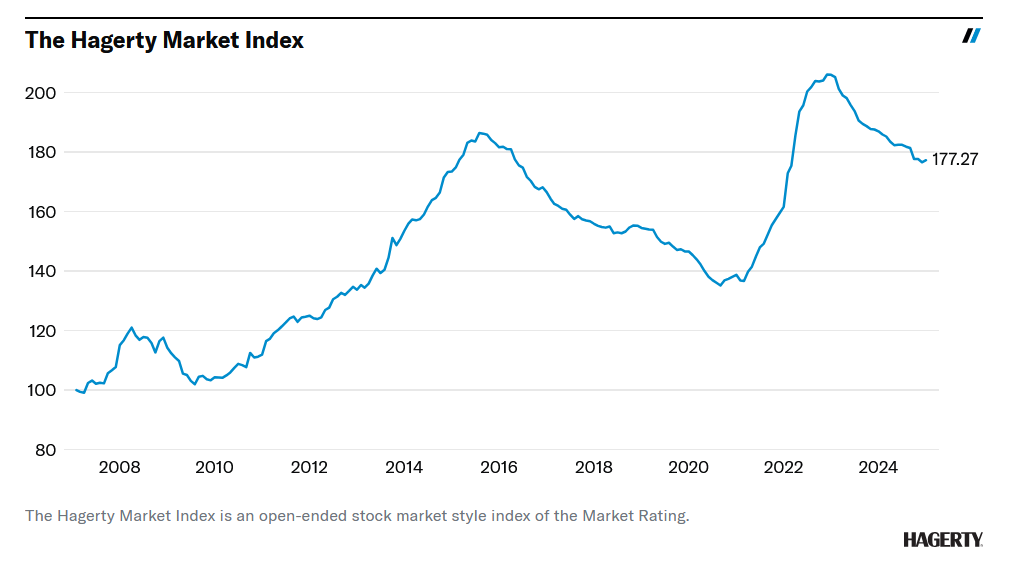

The Hagerty Market Rating measures the current status of the collector car market in terms of activity or “heat,” directional momentum, and the underlying strength of the market. It is expressed as a closed 0-100 number with a corresponding open-ended index (like the DJIA or NASDAQ Composite). To learn more about how to calculate the Hagerty Market Rating read here.

The Hagerty Market Rating has increased for the first time in 10 months, after moving up 0.12 points from last month. This marks only the 4th time the Market Rating has increased in the nearly three years since its fall from 2022’s high point. Even so, its current value of 61.01 still sits below the Market Rating’s score two months ago.

The Hagerty Market Index, an open-ended stock-market-style version of the Market Rating, also increased this month with a 0.69-point bump. This is only the second time that the Market Index has increased since its all-time high 25 months ago. Since then, the Market Index has decreased 14 percent.

While the number of cars sold increased slightly, the Overall Auction Activity metric fell another 0.32 points this month. This metric is continually pulled down by the Median Sale Price, which fell another 0.85 points this month to a new all-time low, continuing its 21-month losing streak. While inflation does influence this metric, it is not the main cause of its decline, as the real dollar value has severely dropped in recent years. The current median sale price of $27,500 is down 20 percent from its high of $34,560 in the fall of 2022. In fact, the Median Sale Price has retreated to a value not seen since the summer of 2020, when the pandemic had it’s strongest negative effect on the market. When accounting for inflation, the current Median Sale Price is at its lowest point since it was included in the Market Rating calculations 13 years ago.

The combined Private Sales metric has taken a similar path, falling 0.82 points this month to its lowest value since Fall 2021. Currently, only 39 percent of cars are selling above their insured value, which is the lowest this ratio has been in three years. This is punctuated even more by the fact that insured values are rising at a much slower velocity than they had been in recent years.

The ratio of insured value increases-to-decreases for cars valued over $250,000 has dropped for 14 consecutive months, falling to its lowest point since early 2021. At the height of the pandemic boom, for high-end vehicles, this ratio was 6.6-to-1. After its continued slide, the ratio sits a 1.54-to-1, just barely above its all-time low of 1.36-to-1. More mainstream and affordable vehicles, however, have fared much better through this cooling market. While their ratio of value increases-to-decreases dropped slightly this month, it has hovered around 8.2-to-1 for the past 15 months.

Even as many of the usual metrics continue to fall, nine of the 14 component metrics in the Hagerty Market Rating increased this month, which is the most since the Market Rating started its slide in late 2022. That said, six of the nine increased metrics are specific to the Hagerty Price Guide, which saw a new update at the start of the month.

Since the Price Guide is refreshed on a quarterly schedule, the Market Rating metrics for months between price guide editions are calculated by extrapolating the trend line. Average and median condition #3 (“good”) values in the October 2024 edition of the Hagerty Price Guide saw a sizeable decrease compared to the prior edition (July 2024), which forced these metrics even lower when the trend line was extrapolated for November and December of 2024. The true values of the average and median condition #3 in the January 2025 edition were negligibly different from the October 2024 edition, but because December 2024 was pulled down, the Hagerty Market Rating metrics associated with the price guide saw a significant increase.

It’s the same story with the Blue Chip and Hagerty Hundred indexes. While the real values actually decreased from October 2024, when accounting for inflation, their Market Rating metrics saw a slight bump, because the values for December were significantly sand bagged by the extrapolated trend line. Next month, it is likely that the Hagerty Price Guide metrics will see a decrease since there was little change in values from the last edition of the price guide and thus will stay relatively flat in the extrapolated trend line, and will not be able to outpace inflation.

January is a great time to test the temperature of the market as thousands of classic cars cross the block at live auctions in Kissimmee and Scottsdale. The industry experts are feeling restrained optimism for strong results from these auctions, but wait until the results are finalized as the numbers won’t hit the market rating until next month.

Report by Adam Wilcox

find more news here.