The collectability of Lamborghinis has traditionally trailed that of more established marques like Ferrari and Porsche. The reasons are many: small production numbers, miniscule motorsports history, and a variety of corporate owners who sometimes mishandled the brand. However, while the market has continued to cool after its brief pandemic bubble, there are signs that the market for Lamborghinis is once again going to go its own way.

Some recent standout auction sales highlight the shift. Notably, the 1972 Lamborghini Miura SV that sold for a record $4,900,000 recently set off our market indicator light here at Hagerty. The price is a new record for the model and some 34 percent above its Hagerty Price Guide condition #1 (“concours”) value. Not even a week later, a low-mileage early 2003 Lamborghini Murcielago with less than 5000 miles sold for $508,500, which was 67 percent above its condition #1 value. Coincidence? Or a sign of something more?

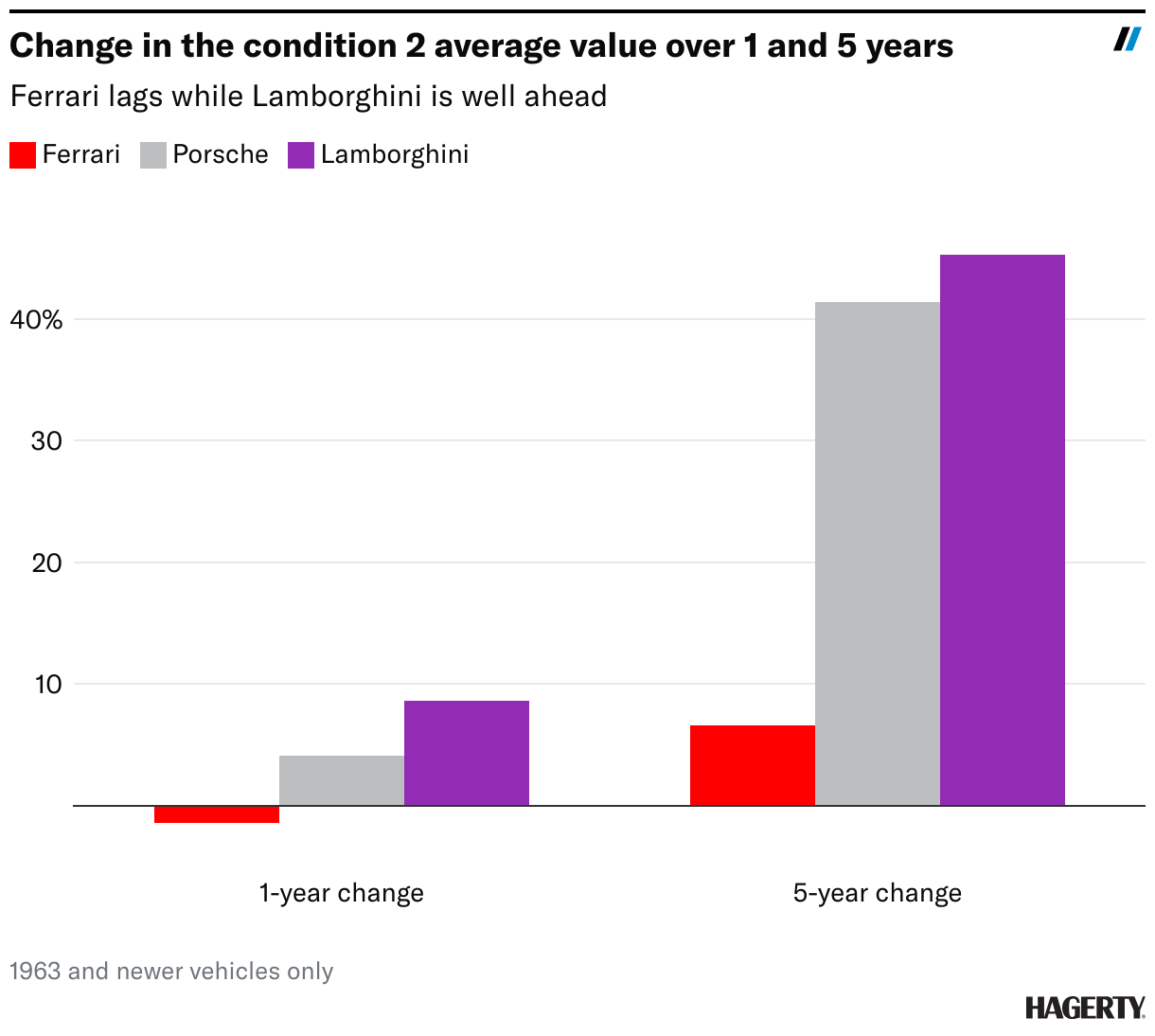

Hagerty Price Guide values for Lamborghini are appreciating faster than its old-school rivals Ferrari and Porsche. For 1963 (when Lamborghini started building cars) and newer vehicles, appreciation for the average condition #2 (“excellent”) value of Ferraris (all 379 of them in the guide for 1963+) is up just 6.6 percent over the past five years. For 1963+ Porsches, the average #2 value is up 41 percent over the same period, and for Lamborghini’s it’s up 45 percent. The difference is even greater over the past year, with Ferrari down 1.4 percent, Porsche up 4.1 percent, and Lamborghini up 8.6 percent.

What’s behind the growing interest in the supercars from this tractor maker turned performance icon? One explanation is that the marque’s demographics are particularly youthful, with 85 percent of Hagerty insurance policy quotes for Lamborghinis coming from Gen X and younger enthusiasts last year. It compares well to Ferrari and Porsche, at 66 percent and 60 percent, respectively.

The visibility of the cars is likely helping, too. Sure, Lamborghinis like the Miura and Countach have always been overexposed in the media, but now there’s social media ready to capture when someone like F1 driver Lando Norris takes out his Miura in Monaco (nearly 7000 videos on YouTube).

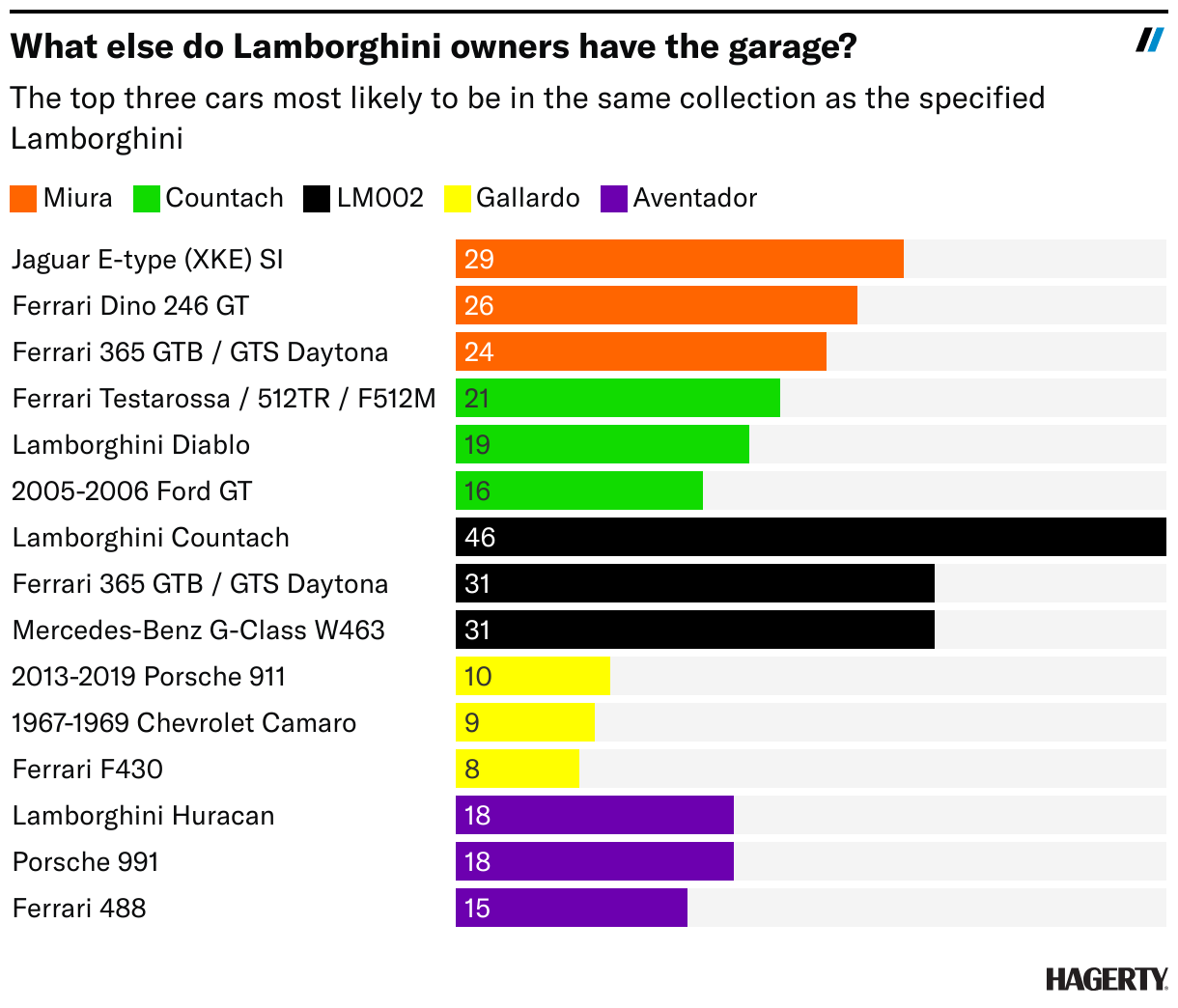

If Lamborghini is, well, maturing as a collectible marque, what other vehicles are in the garages of those collectors? Insurance data shows they often overlap with competing vehicles from Porsche and Ferrari. Lamborghini Gallardo and Aventador owners are most likely to have a Porsche 991, while Countach owners are most likely to have a Testarossa. Looking a bit deeper into the collections, LM002 owners like Countachs best, followed by Ferrari Daytonas, and the W463 Mercedes-Benz G-Wagen. Miura owners are most likely to have a Jaguar E-type followed by a Ferrari Dino or a Daytona. It looks like Lamborghinis have a place in solid collections.

With the Lamborghini market appearing to be on an upswing, what is the outlook? For a prior up-and-coming marque—Porsche—the market for all things Stuttgart was hot 10 years ago but has leveled off since. Similarly, Ferrari has seen a couple of cycles both in the late 1980s and again in the early 2010s, with values either crashing or leveling off after those two prior peaks. The question for Lamborghini is how far the bull market will run.

find more news here…