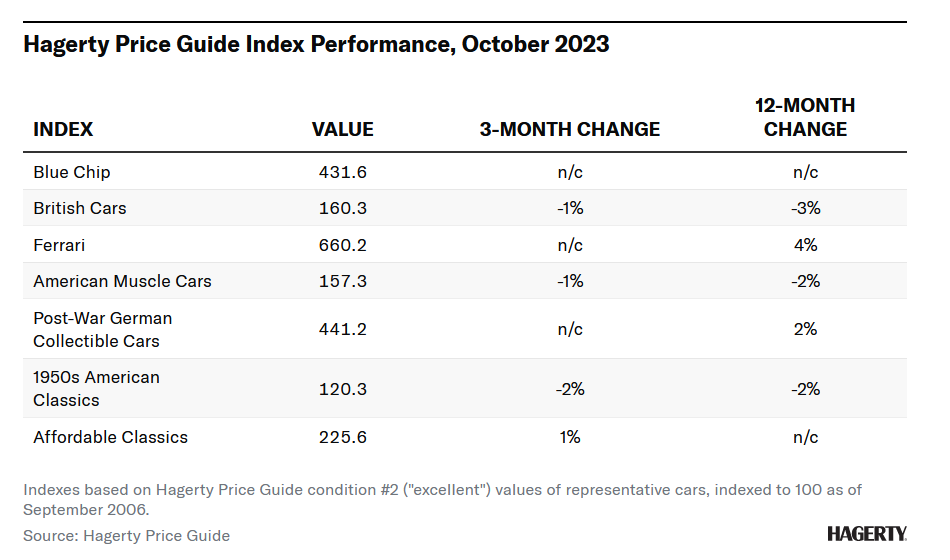

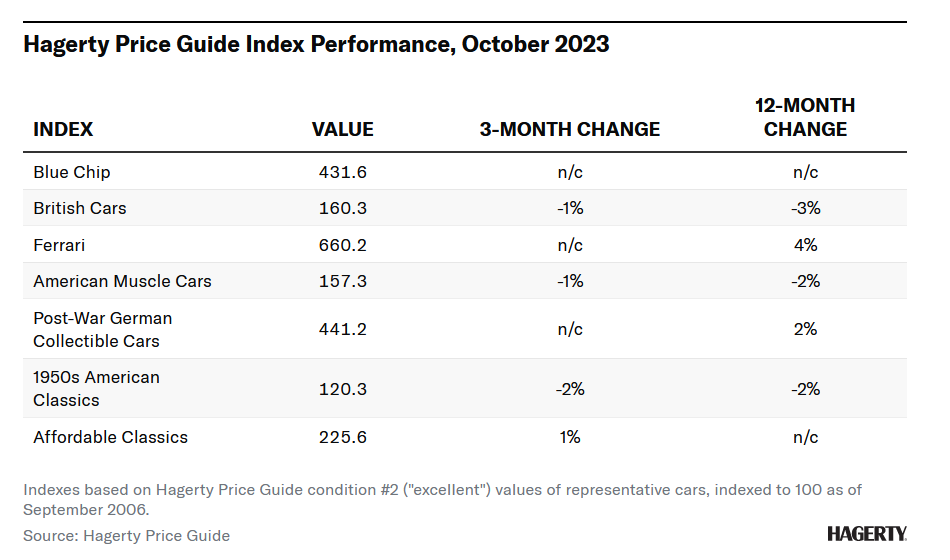

The Hagerty Price Guide Indexes—first published in 2009—are seven stock market-style indexes that average the condition #2 (“excellent”) values of representative vehicles, or “component” cars, from a particular segment. These indexes provide an overview of how these segments of the collector car market are performing overall as well as relative to each other.

As the performance of the latest Hagerty Price Guide indexes show, the collector car market continues the prolonged slowdown that began in the summer of 2022. For some segments and some cars, this slowdown is translating to modestly falling prices. Buyers and sellers alike are learning to reset expectations and move on from the rapid and occasionally incomprehensible appreciation that boomed during the COVID-19 pandemic. Of the seven primary indexes Hagerty reports on each quarter, three dropped in value, one increased, and the remaining three were essentially unchanged. Changes in both directions were modest, underscoring that the market is not presently undergoing a correction.

Holding steady were the three most expensive indexes: Blue Chip, Ferrari, and German. The lone gainer this quarter was the Affordable Classics index, which only grew by one percent. On the downside, Hagerty’s index of 1950s American cars dipped by two percent, while the Muscle Car and British Car indexes each slipped by one percent.

The collector car market is cyclical, just like any other, and the data suggest it’s in the midst of transitioning to a new phase. Below is an overview of each index’s performance updated to include the third quarter of 2023.

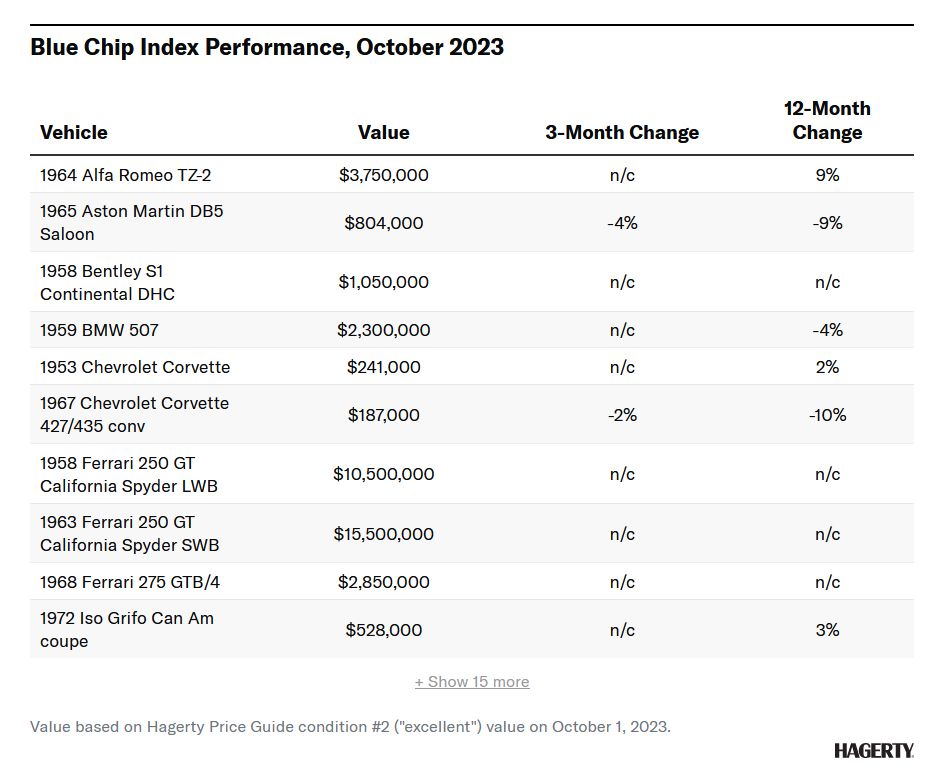

Blue Chip Index

The Hagerty “Blue Chip” Index of the Automotive A-List is a stock market-style index that averages the values of 25 of the most sought-after collectible automobiles of the post-war era.

Hagerty’s Blue Chip index had an uneventful quarter to pair with an uneventful year—the index overall didn’t move during the last three months and has remained unchanged over the last 12. There is minor movement below the surface, though, as six of the 25 cars in the index dropped in value. Notably, the 1965 Shelby GT350 lost eight percent and is now trading at values last seen in January 2021; the Aston Martin DB5 slid by four percent and is down a sizable 30 percent from 2017 prices; the Shelby Cobra 289, Lancia Aurelia B24 Spider America, and Maserati 5000GT Frua coupe also all shed four percent this past quarter; and the 1967 Chevrolet Corvette L71 convertible slipped by two percent. This period marked the highest number of Blue Chip component cars losing value since September of 2020. Despite these decreases, nearly 80 percent of the cars in this index held steady, which was enough to keep the index’s overall average unchanged for the quarter, and 11 percent ahead of where it was three years ago. Given this group’s long track record of collectability and the fact that these cars haven’t soared in value since 2020, Hagerty expects them to remain relatively stable in the short term.

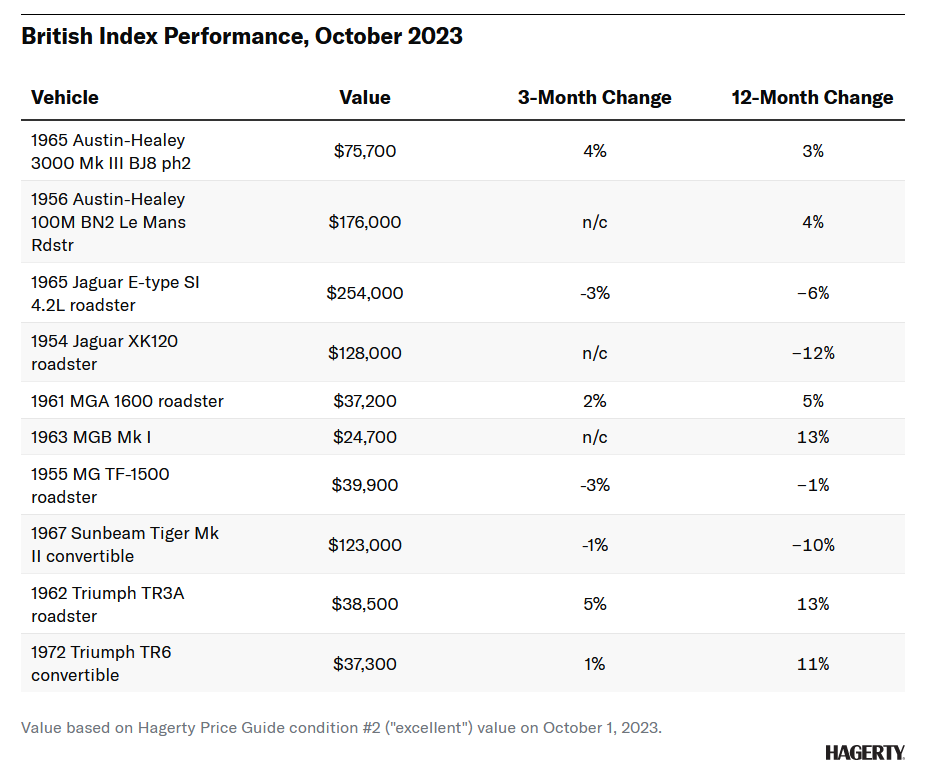

British Index

The Hagerty Index of British Cars is a stock market-style index that averages the values of 10 of the most iconic British sports cars from the 1950s-70s.

Hagerty’s British Car Index has historically been one of the quietest of the segments Hagerty routinely tracks, so it’s slightly surprising this group of cars experienced a second consecutive quarter of falling prices. “Slightly” being the operative word, as the magnitude of change for both periods is a characteristically modest one percent. Despite these downward moves, the index is still eight percent above its 2020 levels.

Movement was mixed, with four cars moving up, three cars moving down, and three holding pat. Winners include the Triumph TR3A, which gained five percent; the 1965 Austin-Healey 3000 BJ8, which moved ahead four percent; the MGA roadster, which rose two percent; and the Triumph TR6, which inched up a single percent. The three that lost ground were the MG TF with a three percent slide; the Sunbeam Tiger II, which dropped one percent; and the Series I Jaguar E-type roadster, whose value sank by three percent despite a record-setting E-Type roadster auction result in September. The British Index focuses on cars from the 1950s and 1960s, which isn’t the era currently in favor with collectors. But as cars like the Mazda Miata and BMW Z3 have elevated in price, it’s possible the personality and presence vintage British cars deliver may put them back on collectors’ lists.

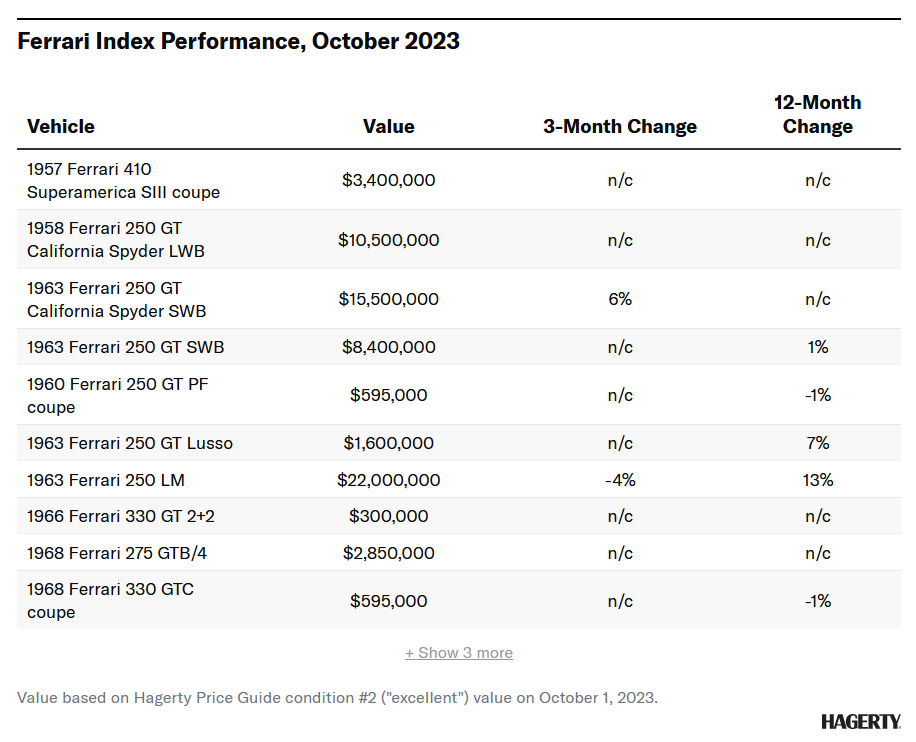

Ferrari Index

The Hagerty Ferrari Index is a stock market-style index that averages the values of 13 of the most sought-after street Ferraris of the 1950s-70s.

The Ferrari market was remarkably quiet this past quarter, with the Ferrari Index remaining unchanged. This may seem odd given how the Monterey auctions underwhelmed and a few headline Ferraris at the August sales fell short of pre-sale estimates, but overall the cars from Maranello outperformed other luxury performance brands like Porsche and Mercedes-Benz in terms of prices paid and sell-through rate to keep values in check. There were also several private sales to confirm the market hasn’t dropped for Enzo-era Ferraris, particularly if they are well-documented examples with no stories.

Only three of the ten cars that comprise the index moved at all. The 250 GT Lusso was the lone winner, etching a strong quarterly gain of seven percent, while the 250 GT PF coupe and 330 GTC both shed a percent. As buyers become more discerning, expect Ferraris built up to 1974 to hold their value well. The brand has an undeniable appeal among enthusiasts at large, and Ferrari collectors continue to recognize the lineage between today’s model lineup and the cars from the 1960s and early 1970s. This cultural relevance pairs with low production numbers to help ensure that supply doesn’t outpace demand.

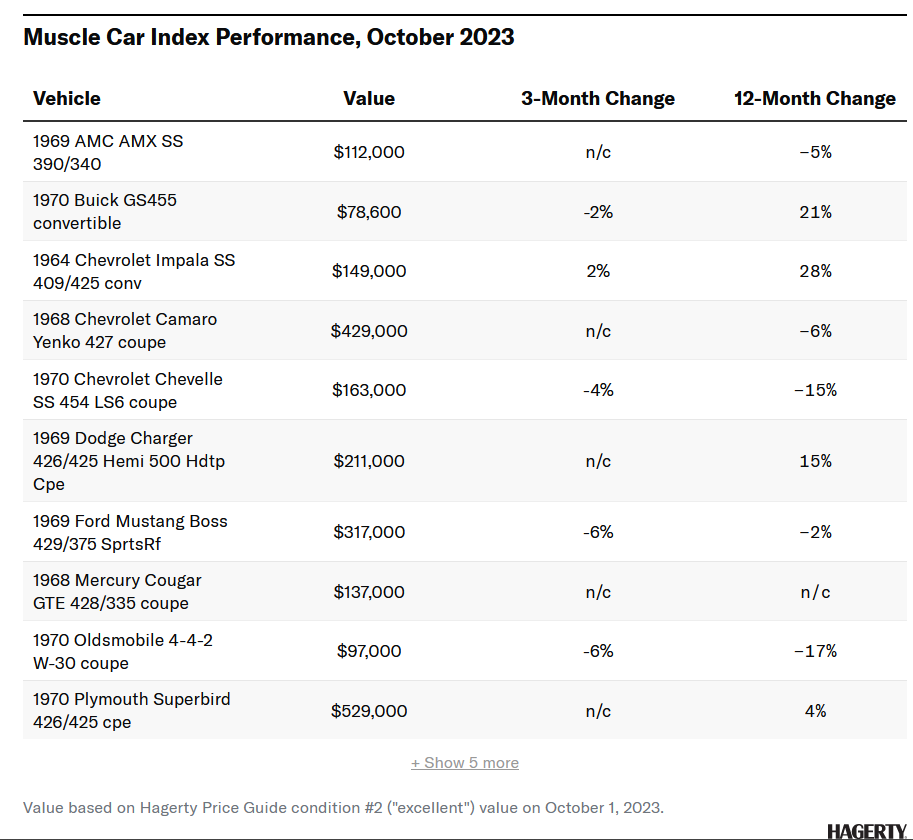

American Muscle Car Index

The Hagerty Index of American Muscle Cars is a stock market-style index that averages the values of the rarest and most sought-after muscle cars.

Muscle Cars have been the strongest performing index of the last two years, though that wasn’t apparent this quarter. Instead of leading the pack, the index dropped one percent, and only one component car gained in value—the 1964 Chevrolet Impala SS 409 convertible, which inched up two percent and has now doubled its value since 2020. Meanwhile, five cars from the index saw prices fall: the 1965 Shelby GT350 dropped eight percent; the Oldsmobile 4-4-2 slid six percent and is now 17 percent below where it was a year ago; the 1969 Ford Mustang Boss 429 lost six percent, giving back all of its gains from the past year and then some; the 1970 Chevelle SS 454 LS6 convertible dipped four percent, leaving it 15 percent below 2022 levels; and the 1970 Buick GS455 convertible dropped two percent, though this follows a long rally of rising prices that leaves it 21 percent above where it was 12 months ago.

Hagerty expects muscle car prices to remain relatively stable for the remainder of 2023 as the market becomes seasonally quiet. The muscle-heavy January auctions will then set the tone for the first half of the year, with buyers, sellers, and dealers all interpreting how buoyant—or sluggish—sale prices are.

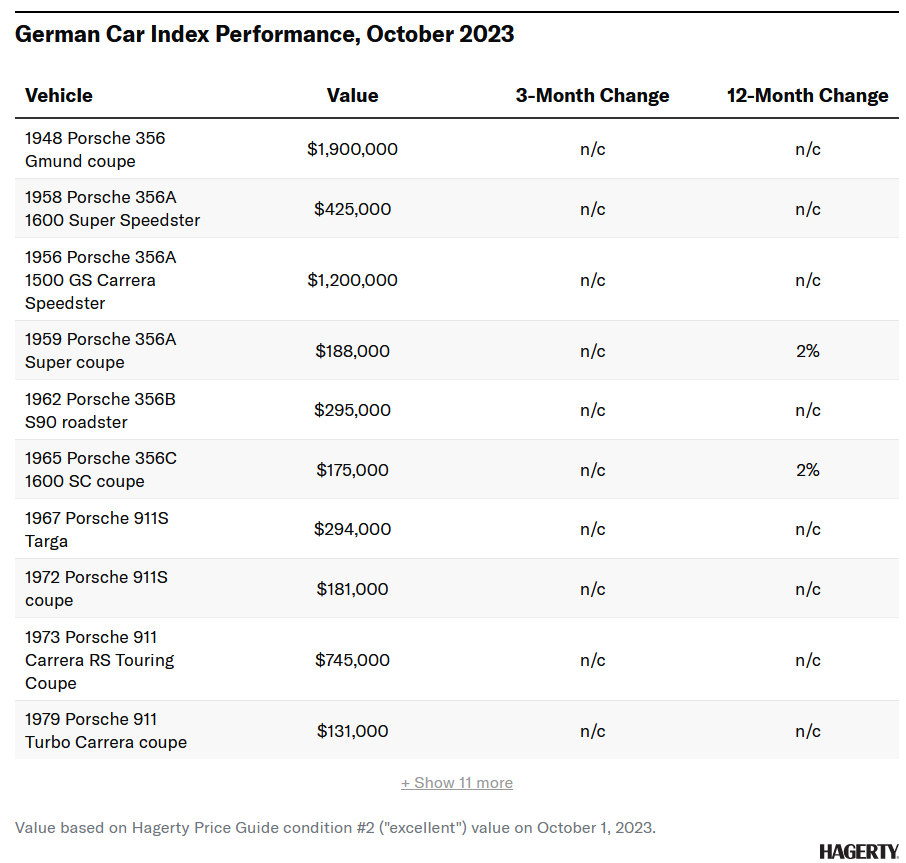

German Car Index

The Hagerty Index of German Cars is a stock market style-index that averages the values of 21 of the most sought-after cars from BMW, Mercedes-Benz, and Porsche from the 1950s-70s.

Hagerty’s German Index was flat during the third quarter, with only two of the index’s 21 cars advancing in value, and five retreating. The index is up two percent over 12 months and 17 percent over the last 36.

Price changes by brand were mixed. The 1970 Mercedes-Benz 280 SE 3.5 Cabriolet increased by a strong eight percent, while the Mercedes 600 limousine mostly offset those gains by falling 12 percent. The stately 300Sc Cabriolet deflated by two percent, and the 190SL lost one percent. BMW had similar behavior: the 1973 2002tii sedan gained four percent, while the 1973 3.0 CSL “Batmobile” lost the same amount and the 1979 M1 fell by three percent. All Porsches built before 1980 remained unchanged. Over the last decade, fans of German cars have become infatuated with models from the 1990s and later, which has made this lower-case “classic” segment much quieter. That lower appreciation, however, will likely insulate them more than their younger peers as conditions shift to a buyer’s market.

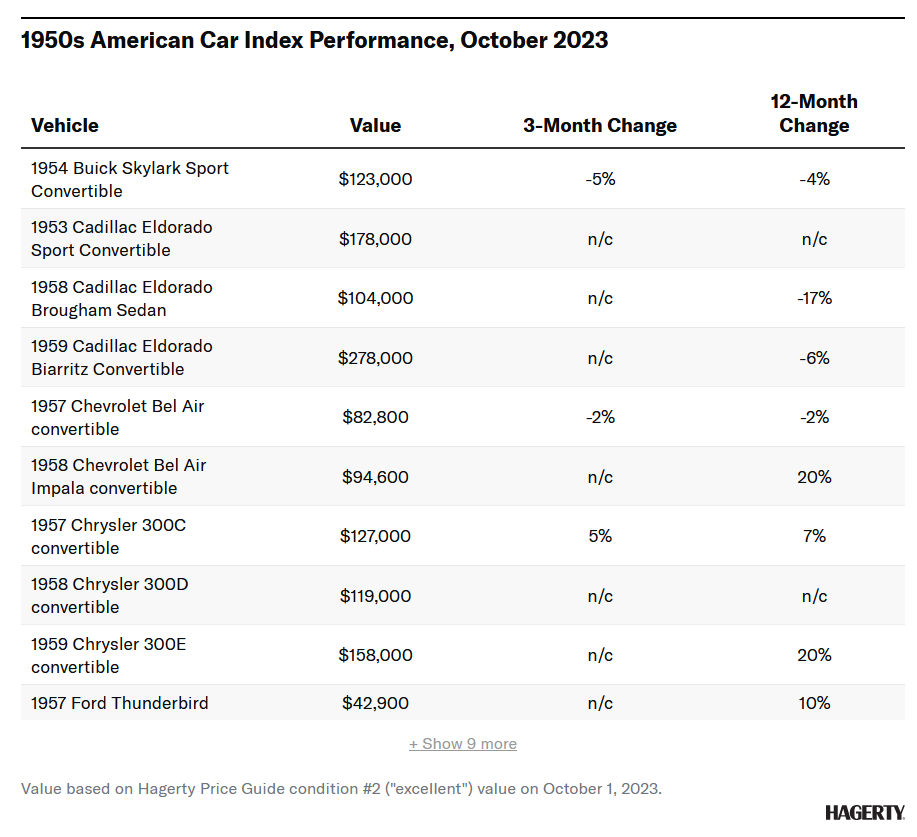

1950s American Car Index

The Hagerty Index of 1950s American Classics is a stock market-style index that averages the values of 19 of the most sought-after collectible American automobiles of the 1950s.

The index of 1950s American cars recorded the largest drop of any group Hagerty regularly reports on this past quarter, although that decline was a modest two percent. That’s the same amount the index is down for the past 12 months, and leaves the group 10 percent above where it was three years ago.

Gainers were few, with only two of 19 cars increasing in value: the 1957 Chrysler 300C (up seven percent) and the Continental Mark II (up one percent). Five of the index’s 19 cars lost ground, with quarterly drops that were some of the biggest among any of the cars found in Hagerty’s seven indexes. Specifically, the 1953 Oldsmobile Fiesta convertible lost 15 percent, the 1953 Hudson Hornet convertible fell ten percent, the 1957 Pontiac Bonneville slipped nine percent, the 1954 Buick Skylark sunk five percent, and the 1957 Chevrolet Bel Air dropped two percent.

For more than a decade people have opined that these cars will slowly fade to obscurity as younger buyers who have no firsthand association to these cars become increasingly active. While that may play out to some degree in the long run, right now there are still enough older enthusiasts trading these cars among each other to keep the segment moving, even if prices have been softer than the rest of the market.

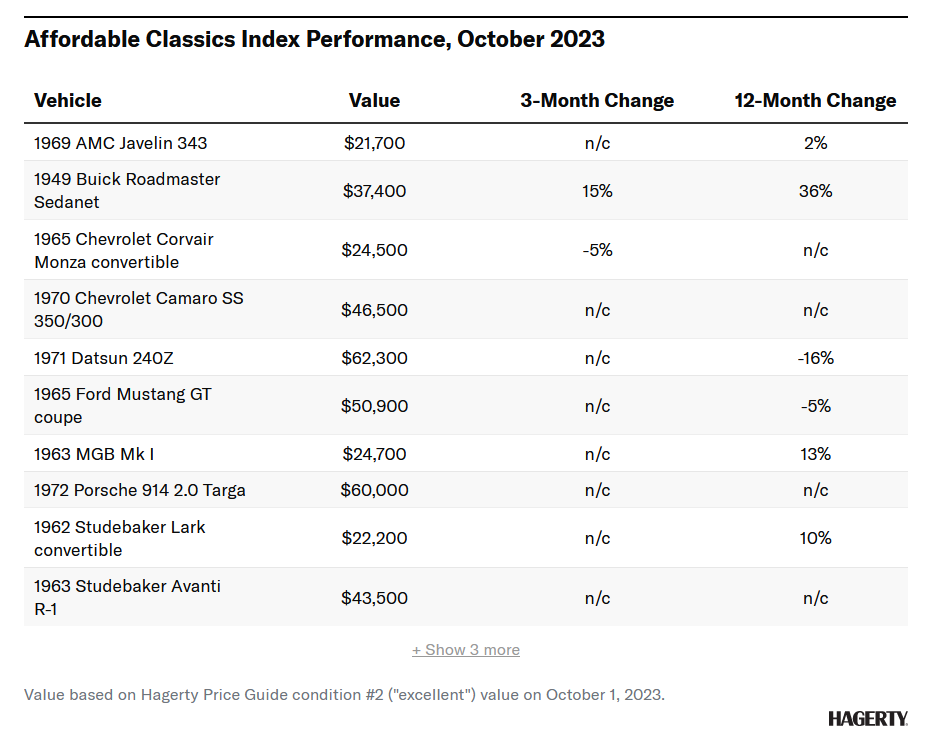

Affordable Classics Index

The Hagerty Index of Affordable Classics is a stock market-style index that averages the values of 12 undervalued cars, priced around $40,000, from the 1950s-70s.

Hagerty Affordable Classics index has been one of the most consistent performers of the seven primary indexes Hagerty routinely reports on. So much so that the index’s $20,000 average from 2009 has since climbed to $40,000. Even still, this group of cars isn’t immune to broader market conditions, and it only notched a one percent gain over the last three months. Furthermore, the last year has been the slowest period of growth for this group of cars since 2017 (when all of the other indexes were retreating).

There was no consistent theme about which cars rose and which ones fell. The 1949 Buick Roadmaster Sedanet posted a big bump of 15 percent, while the 1965 Chevrolet Corvair slumped by five percent. Volkswagen won as the 1967 Beetle gained a point, but it also lost as the Karmann Ghia tumbled by four percent.

These mixed results indicate that cars priced at this level are experiencing normal volatility within an otherwise staid environment, as opposed to any particular sub-segment trending one way or another.

Report by Brian Rabold

find more news here…